Chris Thompson | Head of Research | Ubika Research | Chris@UbikaResearch.com | 1 (416) 574-0469

Patrick Smith | Analyst | Ubika Research | Patrick@UbikaResearch.com | 1 (647) 444-5506

Alp Erdogan | Analyst | Ubika Research | Alp@UbikaResearch.com | 1 (647) 479-5690

Richard Waxman | Associate | Ubika Research | Richard@Ubikaresearch.com | 1 (647) 770-2185

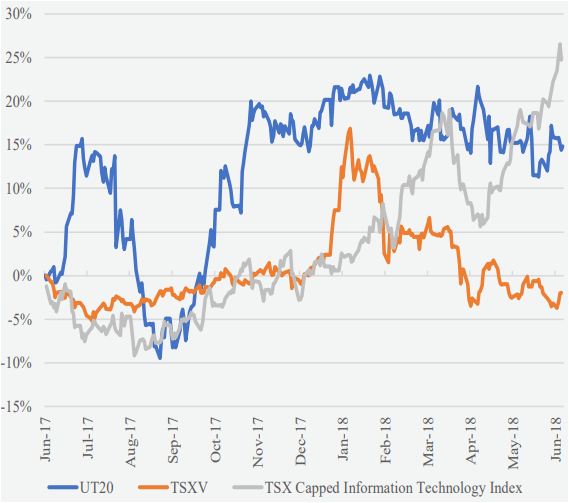

The Ubika Technology 20 Index has generated a year-over-year return of nearly 15%

Ubika Tech 20 (April 23, 2018 - June 11, 2018)

UT20: -1.7% (14.8% Y/Y)

TSX Venture: -3.9% (-2.2% Y/Y)

TSX Info Tech: 13.7% (25.1% Y/Y)

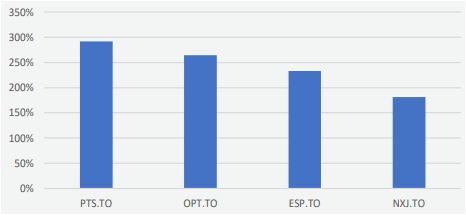

Top Volume Gainers (m/m)

The Ubika Technology 20 Index has remained flat since our last report dated April 23, 2018. In that time, it outperformed the TSX-V, but underperformed the TSX Capped Information Technology Indices, which fell 3.9% and increased 13.7%, respectively, over the same period. Notable performers for this report include:

Industry Highlights

- Facebook (NASDAQ:FB) has unveiled its lineup of news programs from CNN (NYSE:TWX), Fox News (NASDAQ:FOX), and others, that will air on its new Watch section. In an attempt to combat the fake news controversy that the Company has been roiled in since the 2016 U.S. election, it has explained that it will be reducing the amount of news in its user’s feeds, and instead promote news from its own news programing. The content will be produced by various reputable news organizations but will be directly funded by Facebook itself.

- Former CEO of Qualcomm (NASDAQ:QCOM), Paul Jacobs, is starting a new company that will focus on 5G wireless technology. The new company will be called XCOM and is being cofounded with two other former Qualcomm executives. Jacobs was removed from his CEO position by the Board of Directors in March, after he informed them of his desire to take the company private, following its failed merger with Broadcom (NASDAQ:AVGO).

- On June 4, 2018, Microsoft (NASDAQ:MSFT) announced it had reached a deal to acquire GitHub for $7.5B. GitHub is a popular code repository used by more than 28M programmers. The platform makes it easier for programmers to collaborate and roll out updates to customers more regularly. The deal is

expected to close before the end of 2018.

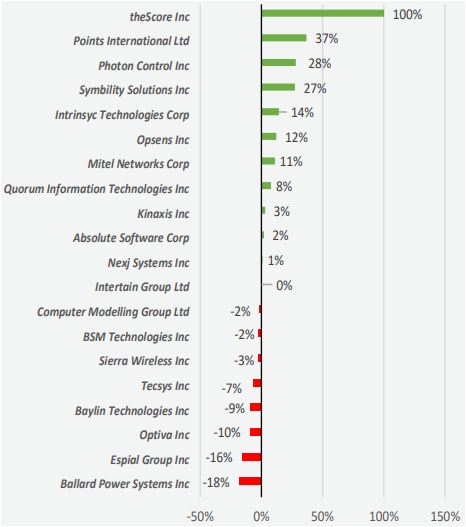

Ubika Tech 20: Performance Distribution

Upcoming Conferences

Big Data Toronto, June 12-13, Toronto, Canada – With 4000 attendees, 100+ speakers, and 60+ exhibitors. This event brings Big Data experts together to discuss predictive analytics, advanced machine learning, data governance, privacy, cybersecurity, Smart Home & IoT, digital transformation, Hadoop (an open source software platform), cloud analytics and cloud computing.

Notable Performers:

Points International Ltd. (TSX:PTS)

Points International is a Canadian technology company that provides loyalty eCommerce and tech solutions to some of the world’s top brands, helping increase their loyalty program revenues and member engagement. Since our last report on April 23, 2018, the stock has gained 37%.

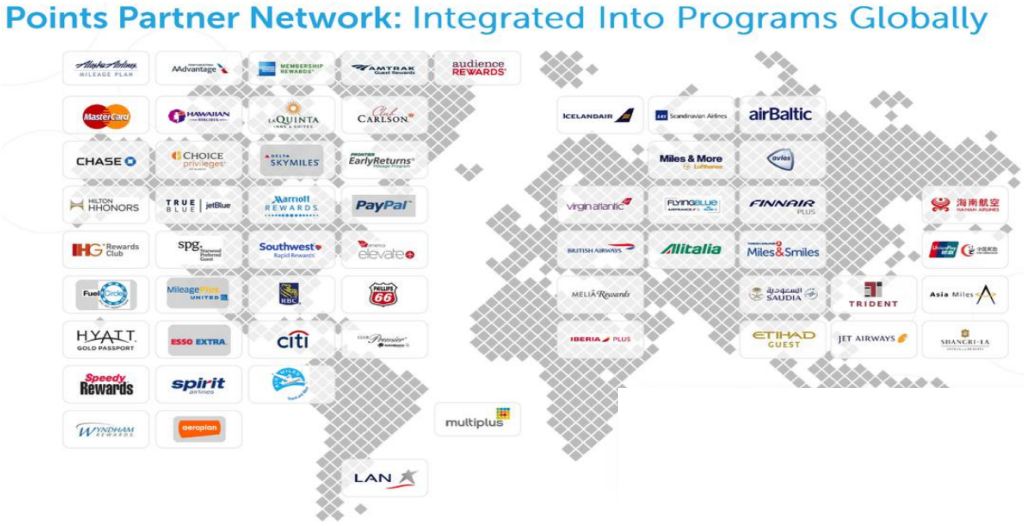

Points works with companies such as Aeorplan (TSX:AIM), Esso (TSX:IMO), Hilton (NYSE:HLT), and Fairmont to create and administer customer loyalty programs. A sample of its associated brands can be found in Figure 1. It establishes long-term contracts with brands, to buy units (such as air miles) at a wholesale price. It then markets those units to consumers in exchange for loyalty points that the customer has accumulated on the points platform.

Figure 1: Points Partner Network

Source: Points International Investor Presentation

Source: Points International Investor PresentationOn May 11, 2018, Points announced it would begin a program to repurchase 133,000 shares at a price of $10.81. The stock price rose 22% over the following two weeks.

Points is covered by two analysts with an average price target of $16.00, representing a 13% downside. It currently has two Buy ratings and zero Sell ratings.

theScore Inc. (TSXV:SCR)

theScore is a sports and esports media company operating in Toronto. The Company’s stock price soared 100% since our last report date, driven by a favourable United States Supreme Court Ruling, easing the restrictions on sports betting.

The Company operates a sports news platform with ~4.1M average monthly active users, with each user visiting the site an average of 85 times per month. The Company receives users primarily through its award-winning iOS and Android mobile apps, with iOS app users up 9% Y/Y and Android users down 11% over the same period. theScore provides users customizable news for all major leagues and sports, using push notifications, multimedia articles, and social media sharing. In addition to its app, the Company operates theScore.com, which offers many of the same features as the mobile application. theScore also operates several side applications. Additionally, the Company operates a chatbot in Facebook Messenger and Kik Messenger, allowing for real-time scores and news through a new platform.

The Company also operates an esports app, covering popular video games such as League of Legends, DOTA 2, and CS:GO, the first offering of its kind by a major media company. As for regular sports, the Company provides news, scores, statistics, and notifications, through the app as well as theScoreesports.com.

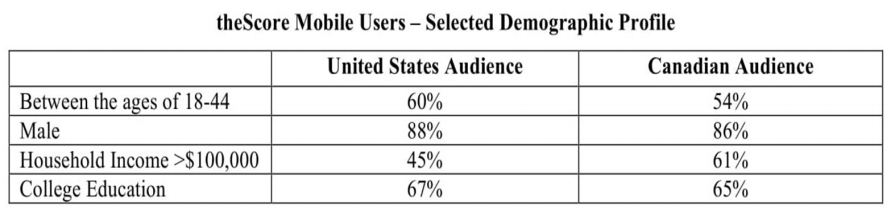

The Company derives its revenue from advertisements in its app and website. As a sports site, it appeals to a highly-focused target audience. Figure 2 contains a chart of selected user demographics.

Figure 2: Mobile User Demographics

Source: theScore 2017 Annual Report

Source: theScore 2017 Annual ReportThe Company has an average price target of $0.30, representing a 0% upside. The Company has two Buy ratings, one Hold rating, and no Sell ratings.

Photon Control Inc (TSX:PHO)

Photon Control is a technology company that develops fibre optic temperature positioning and control systems to improve the performance of computer chips. The Company’s stock has returned 28% since our last report on April 23, 2018.

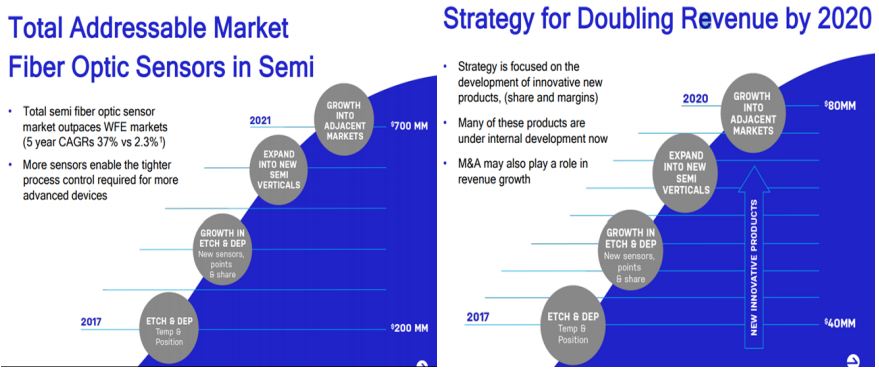

Photon targets semiconductor manufacturers and other solid-state computer chip designers. These chips require precise temperature control to run at optimal performance and thus are designed in partnership with companies such as Photon, that are able to provide the necessary components. The Company claims that its products are differentiated from competitors by their ability to perform in the harshest environments with the highest accuracy. The Fibre Optic Phosphor Thermometry technology outperforms traditional IR sensors and ensures temperature uniformity across the wafer, resulting in superior performance of the chip. The Company estimates that its total addressable market will grow from $200M in 2017 to $700M by 2020. Photon Control has an ambitious plan to double its revenue to $80M over that period.

The Company’s industry and revenue growth plans can be seen in Figure 3.

Figure 3: Photon Control Market and Growth Strategy

Source: Photon Control Investor Presentation

Source: Photon Control Investor PresentationOn May 10, 2018, the Company released its Q1 earnings, which surpassed expectations. The stock price fell 1% the following day.

On May 13, 2018, The Company announced a share buyback program that would begin on May 24, 2018. The stock price rose 15% over the week following the announcement.

On June 4, 2018, Photon Control opened the Toronto Stock Exchange in celebration of its move from the TSX Venture Exchange to the TSX two weeks earlier. The stock price rose 2% throughout the day.

Photon Control is covered by three analysts with an average price target of $2.88, representing a 26% upside. It currently has three Buy ratings and no Sell ratings.

Upcoming Catalysts:

- German Engineers speculate on Tesla’s battery technology. After acquiring several new Tesla Model 3’s on the grey market, German car makers were surprised to find that the batteries contained significantly less cobalt than expected. The scarce element has been a major cost barrier to battery technology and electric vehicle adoption. If Tesla has developed new battery technology, it may unveil it sometime in the near future.

To read our full disclosure, please click on the button below: