Chris Thomson | Head of Research | Ubika Research | Chris@UbikaResearch.com | 1 (416) 574-0469

Patrick Smith | Analyst | Ubika Research | Patrick@UbikaResearch.com | 1 (647) 444-5506

William Xiao | Associate | Ubika Research | William@UbikaResearch.com | 1 (647) 828-4632

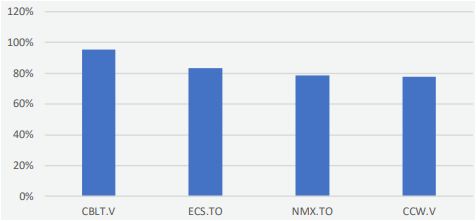

Our Ubika Battery Metals Index eased since the last report as a result of a big drop in Katanga Mining stock

Battery Metals Index (April 13, 2018 - June 1, 2018)

UB20: -11.3% (44.2% Y/Y)

TSX-V: -4.5% (-4.3% Y/Y)

Global X Lithium ETF: 0.7% (12.5% Y/Y)

Dollar amounts in CAD unless otherwise stated.

Top Volume Gainers (m/m)

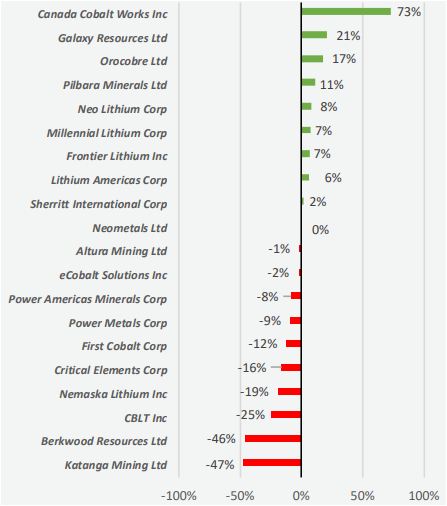

The Ubika Battery Metals Index is down 11.3% since our last report dated April 16, 2018. This decline is driven largely by a 47% drop in Katanga Mining (TSX:KAT) shares, which grew to a significant part of our Index following its rise in December. The fall was caused by the commencement of legal proceedings against the Company’s DRC subsidiary, which could close it. With Katanga excluded, our Index rose 0.6%. Notable performers for this report include:

- Canada Cobalt Works Inc. (TSXV:CCW), which surged 73% following a spike in cobalt prices and progress on its exploration program.

- Neo Lithium Corp. (TSXV:NLC), which increased 8% as construction and testing advances at its 3Q asset.

- First Cobalt Corp. (TSXV:FCC), which declined 12% despite its acquisition of US Cobalt (TSXV:USCO).

Industry Highlights:

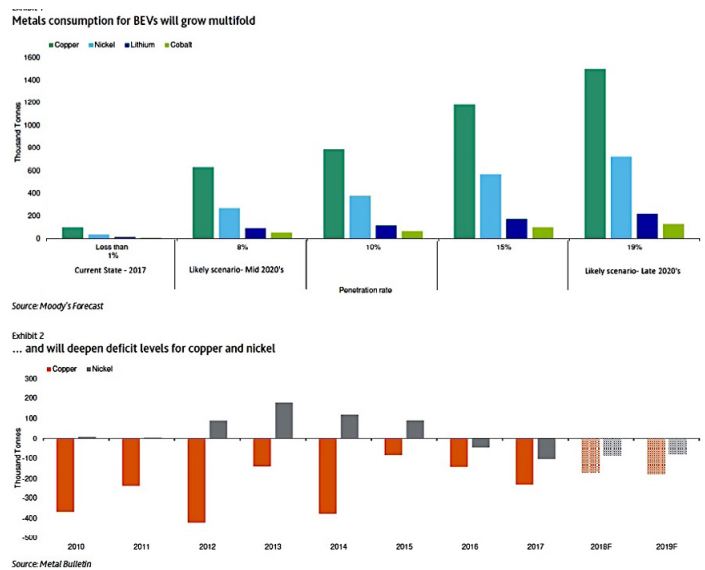

- On May 1, Moody’s released a report on the battery metals supply. Analysts from the organization believe that the battery metals supply could continue to fall as the quantity and production of copper mines declines. Importantly, cobalt is largely produced as a byproduct of copper mining. As consumption rates increase due to the rise in electric vehicles, a supply gap could form, which could raise the prices of battery metals. Below are graphs of battery metals demand growth and deficits in copper/nickel supply.

Figure 1: Battery Metals Demand and Deficits

Source: Moody’s Investor Service Report, Mining.com

Source: Moody’s Investor Service Report, Mining.com- Tianqi Lithium (SHE:002466) plans to purchase 24% of SQM (NYSE:SQM) from Nutrien (TSX:NTR) for US$4.07B. Chile has asked antitrust regulators to block the sale, on the grounds that Tianqi and SQM would control 70% of the world’s lithium production, but no decision has been made. The deadline for action is in August. China condemned the move, stating the efforts could “leave negative influences.” The deal is expected to close by Q4 2018.

UB20: Performance Distribution

Upcoming Conferences:

Mining Investment North America – Toronto, Canada, June 14-15, 2018. Mining Investment brings a series of strategic mining conferences to Canada, bringing together leaders in mining, quarrying and construction materials to discuss and develop new partnerships and opportunities within the industry. The event has about 400 attendees from more than 35 countries.

Notable Performers:

Canada Cobalt Works Inc. (TSXV:CCW)

Canada Cobalt Works is a cobalt developer operating in Canada’s Cobalt Camp. The Company’s stock jumped 73% as cobalt prices rose and the Company advanced its exploration program.

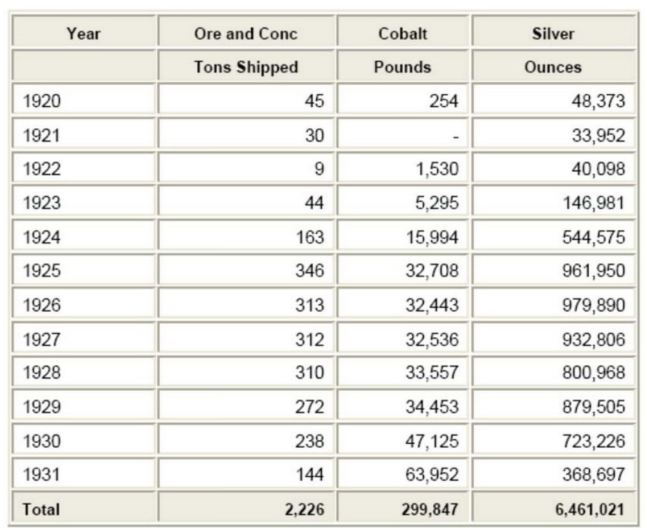

Canada Cobalt Works’ flagship asset is the historic Castle Mine, located in the Cobalt Mining Camp in Ontario. The 28 km2 claim is situated on the past-producing Gowganda silver-cobalt camp, and includes all three of the former Castle Mine’s shafts and adit. The mine hosts 11 levels covering 18km of underground workings. Historically, Castle has produced ~9.5M lbs Ag and ~300,000 lbs Co grading 25 oz./t Ag and 6.7% Co respectively. Below is the production of the mine, formerly named Castle Trethewey.

Figure 2: Castle Trethewey Historical Production

Source: Company Technical Report

Source: Company Technical ReportOver the course of 2017 and H12018, the Company has conducted underground bulk and chip samples and commenced Phase 1 of its drilling program. Highlights include one bulk sample grading 2.5% Co and 199 oz./t Ag.

The Company also owns three other assets located within the Cobalt Mining Camp. The Beaver silver-cobalt mine historically produced 7.1M oz. Ag and 139,000 lbs Co between 1907 and 1940. The Company commenced initial exploration at Beaver in December 2017, collecting hand samples averaging 4.7% Co, 46.9 g/t Ag, and 3.1% Ni. In addition, the Violet mine produced 900,000 oz. Ag between 1919 and 1925.

The Golden Corridor Zone, identified during 2012 near the Castle mine, contains gold-copper mineralization. Trenching and grab sampling yielded promising samples, including a trench assaying 2.24 g/t Au over 2.2m and a channel sample of 3.8 g/t Au over 1.3m. In Q1 2017, the Company conducted a geophysical survey of the area, and plans to conduct further exploration during 2018.

Canada Cobalt Works’ proprietary Re-2OX is an environmentally-friendly hydrometallurgical process aimed at increasing cobalt recovery rates and avoiding the smelting process. CCW aims to launch a pilot plant, advised by Dr. Ron Molnar, who has operated more than 60 pilot plant circuits processing metals.

On May 10, the Company’s stock price began to climb dramatically, rising 17% over the course of a week and a further 14% over the week following. The move is likely driven by a spike in cobalt prices, which have risen from US$40.39 to $41.16 MTD.

On May 23, Canada Cobalt Works provided an update on its exploration program. The Company is preparing the first level of its mine for drilling, targeting cobalt veins found through prior sampling. Significant quantities of mineralized material are being extracted from stopes above the first level, to be sent to an assay lab and to the Company’s own Re-2OX program. Re-2OX plans to create cobalt sulfate test products at the Chinese National Standard, as requested by prospective Asian battery clients. CCW’s stock price continued to rise, increasing 19% over the following week.

On May 31, the Company announced preliminary results from its Re-2OX testing. Re-2OX recovered 99% of cobalt and 81% of nickel from a sample, as well as removing 99% of the arsenic. The sample graded 9.3% Co, 5.7% Ni, 326 oz./t Ag, and 49.9% As. CCW plans to test the process on gold and silver samples, and progress towards the cobalt sulfate standards mentioned above. The Company’s stock price has increased 20% to-date.

CCW provides access to a Canadian cobalt company, as demand for electric vehicles continues to grow. Its competitors in the Democratic Republic of the Congo, where more than 60% of the world’s cobalt is produced, suffer from geopolitical conflict and a punishing new mining code. The Company could continue to see strong returns should its development continue as planned.

Neo Lithium Corp. (TSXV:NLC)

Neo Lithium is a lithium developer progressing towards production in Chile. The Company’s stock price increased 8%, as construction and testing advanced at its 3Q asset.

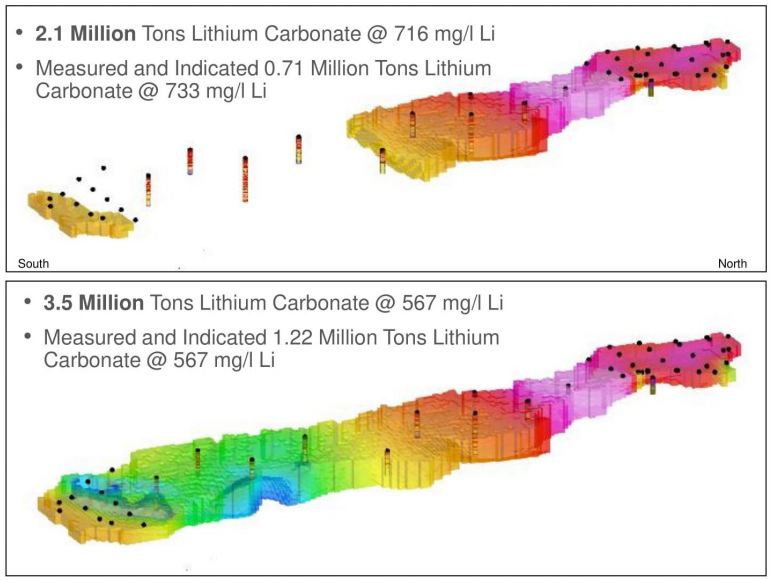

Neo Lithium’s flagship asset is its Tres Quebradas (3Q) Lithium project, located 30km from the border in the prolific Lithium Triangle in Chile. The 350km2 project hosts three brine reservoirs and three salars, fed by geothermal springs, which contain high-grade lithium. According to the Company’s May 2017 Mineral Resource Estimate, the project contains M&I reserves of up to 3.5Mt LiCO2 grading 567 mg/I Li. Results are detailed further in the diagrams below, where more violet colours indicate higher grades of lithium.

Figure 3: Neo Lithium Resource Map

Source: Company Presentation

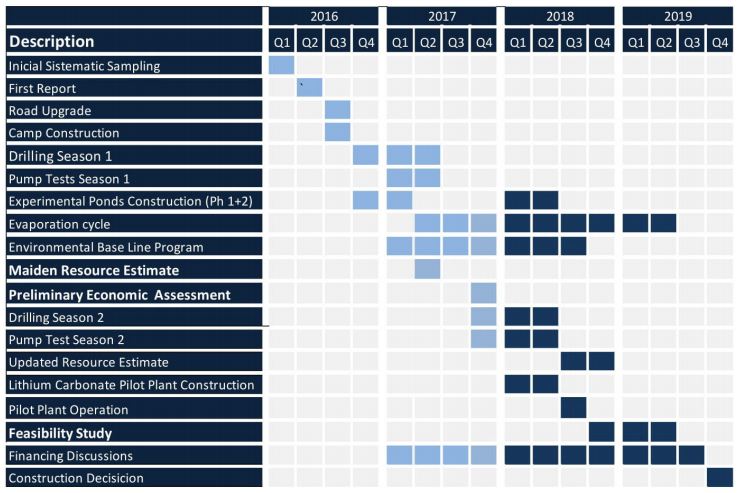

Source: Company PresentationThe Company is continuing construction on 3Q’s infrastructure, having thus far invested $20M into the project. Nine ponds have been completed and a pilot processing plant is currently under construction, which will operate at 1:600 and 1:800 scales to the PEA’s final results respectively. These assets are aimed at enabling improvements to brine processing. According to the PEA, 3Q could produce at an average cash cost of $2,791/t, in-line with other Chilean producers and much better than producers elsewhere. Using an onsite lab and a chemical and engineering team, NLC believes it can reduce reagent costs and increase brine concentrations. The Company aims to complete its Feasibility Study by Q3 2019. Below is a timetable of past milestones and future project goals.

Figure 4: Company Achievements and Goals

Source: Company Presentation

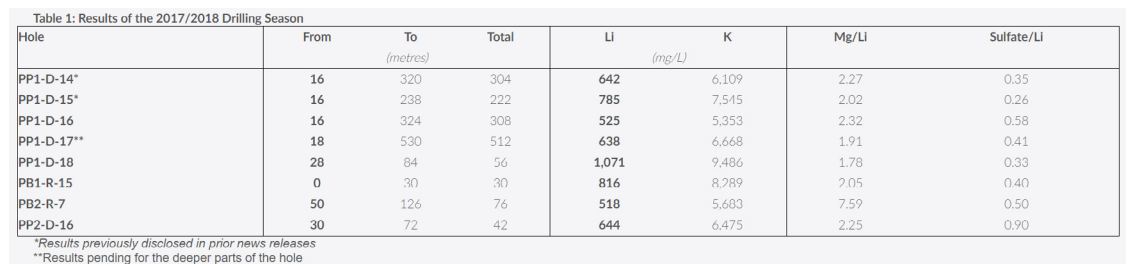

Source: Company PresentationOn March 5, the Company announced the discovery of the deep aquifer mentioned before, as well as several drill results. The Company conducted a 50-linear km seismic reflection survey and 3,200m of drilling, including 512m averaging 638mg/L. Results of the drilling season thus far are below.

Figure 5: 2017/2018 Drilling Season Results

Source: Company News Release

Source: Company News ReleaseThe Company has an average price target of $2.83, representing a 94% upside. The Company has 3 Buy ratings and no Hold or Sell ratings.

First Cobalt Corp. (TSXV:FCC)

First Cobalt advertises itself as the world’s largest cobalt explorer. The Company’s stock has slipped 12% since our last report date, following its acquisition of US Cobalt (TSXV:USCO) in March 2018.

First Cobalt’s most advanced asset is the Iron Creek Cobalt project, located 42km from Salmon, Idaho. The project encompasses 727ha and 90 claims, with 9,100m of historic drilling. In 1980, the area was found to host two mineralized zones with over 400m of strike length, estimated to contain 1.3Mt grading 0.6% Co and 0.3% Cu. 2017 drilling traced mineralization for over 800m. The Company’s 2017 drilling campaign drilled 40 holes and the Company plans to drill ~80 more in 2018, with 15,000m of underground and surface drilling. FCC expects to complete an initial Mineral Resource Estimate by the end of 2018, and begin a Preliminary Economic Assessment in 2019.

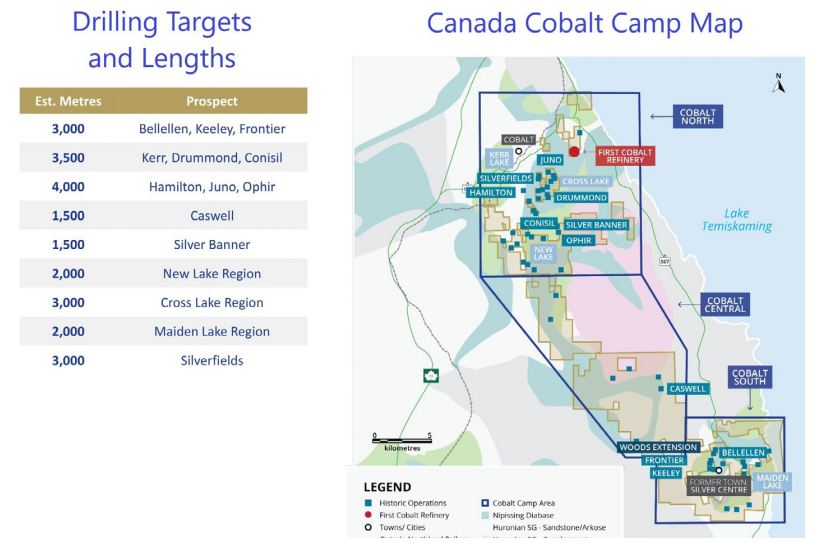

First Cobalt owns ~45% of the Cobalt Mining Camp, including 50 past-producing mines. The 2018 drill program totals 26,500m of drilling across 15 targets, as seen below.

Figure 6: FCC Camp Map and Drilling Targets

Source: Company News Release

Source: Company News ReleaseThe Company also owns the only fully-permitted cobalt extraction refinery in North America, located in Cobalt, Ontario, next to the Cobalt Camp. It contains three circuits, one of which is specially aimed at processing cobalt from the Cobalt Camp, and could produce cobalt sulfate for electric vehicles. The facility has been on care and maintenance since 2015, but FCC is currently conducting a recommissioning study.

On March 14, the Company announced the acquisition of US Cobalt (TSXV:USCO) for $150M in stock. The acquisition adds the Iron Creek project discussed above to FCC’s assets, as well as two minimally-explored lithium assets. The Company’s stock price rose 10% the day of the acquisition. The final order approving the acquisition was granted on May 23, and it is expected to close imminently. Over the month following the acquisition, the Company’s stock

price decreased by 28% as cobalt prices fell 9%.

On April 19, the Company initiated a refinery restart study of the First Cobalt Refinery. A 2012 report by Hatch Canada for a previous order estimated the replacement value of the asset at US$78M.

On May 3, the Company announced that recent drilling results had doubled the strike length of the mineralized zone in the Kerr area to over 200m. Notable drill results include 0.6% Co over 1.8m and 8m of 31 g/t Ag.

On May 15, the Company announced the expansion of its muckpile material review to thirdparty materials. Muckpiles are mine rocks broken during mining, here created during the area’s historic silver mining period.

On May 24, the Company announced that it had further increased the Kerr zone strike length to 350m. New drill results included 0.2% Co, 89.2 g/t Ag, and 1.0% Pb over 1.8m. The Company’s stock price has eased 7% since.

The Company has a price target of $1.30, representing an 81% upside. FCC has one Buy rating.

Upcoming Catalysts

Companies have made progress towards reducing the amount of cobalt in batteries. Tesla (NYSE:TSLA) announced that their Model 3 batteries would use 1/3 of the typical quantity of cobalt. Panasonic (TYO:6752), Tesla’s sole battery supplier, is also in talks with Toyota (TYO:7203) to create a cobalt-less electric vehicle battery. If these efforts succeed, the effects of rising cobalt demand could be mitigated.

Clashes with miners and the Congolese government over its new mining code continue, with miners threatening to sue the government. The code raises taxes and royalties on mining operations, including a potential increase in the cobalt royalty from 2% to 10%, and also removes a clause in the previous mining law that protected mining companies for 10 years in the event of any legislative changes. If the Congolese government bows to international pressure, cobalt supply might be better able to meet demand.

To read our full disclosure, please click on the button below: