Alp Erdogan | Analyst | Ubika Research | Alp@UbikaResearch.com | 1 (647) 479-5690

William Xiao | Associate | Ubika Research | William@UbikaResearch.com | 1 (647) 828-4632

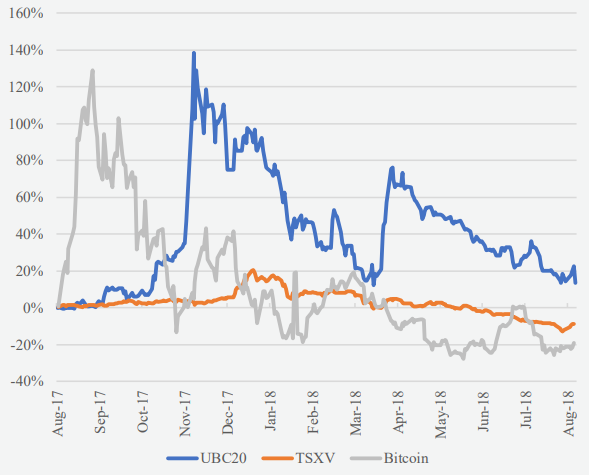

The Ubika Blockchain and Cryptocurrency 20 gained nearly 14% year over year, surpassing the performance of the Toronto Venture exchange

Ubika Blockchain & Cryptocurrency 20 June 18, 2018 - August 24, 2018

UBC20:-15.5% (13.5% Y/Y)

TSX Venture:-5.7% (-7.1% Y/Y)

Bitcoin:-1.2% (57.1% Y/Y)

Dollar amounts in CAD unless otherwise stated.

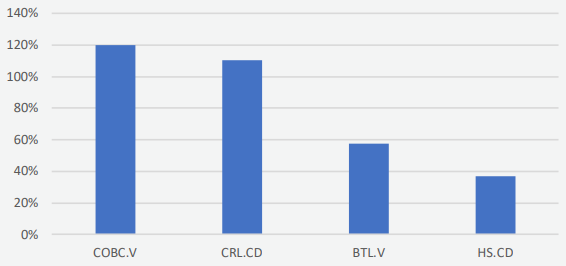

Top Volume Gainers (m/m)

The UBC20 has declined 16.4% since our last report date, underperforming the TSX-V and Bitcoin, which declined 5.7% and increased 1.3%, respectively. Notable performers for this report include:

Industry Highlights:

- The SEC has rejected nine blockchain ETF proposals on the grounds that the Securities Exchange’s rules must be designed to prevent fraudulent and manipulative practices. The proposals offered ties to Bitcoin futures, as opposed to the previously-rejected ETFs that directly hold Bitcoin. The disapproval orders will be reviewed by the Commission as the initial action was written by Commission staffers.

- Blockchain and cryptocurrency media platforms were banned on the Chinese social media platform WeChat. Regulators are planning to block access to overseas foreign crypto exchanges, of which 124 have been identified thus far. China is one of the largest markets for cryptocurrency assets, despite it being illegal in that country, and successful restriction of access could reduce trading volume.

- The National Research Council of Canada (NRC) has supported the development of a blockchain explorer. Built by Bitaccess, the explorer is hosted on IPFS, a peer-to-peer alternative to the HTTP Internet Protocol. The explorer quickly locates information regarding grants and contributions posted to the Ethereum blockchain.

UBC20: Performance Vs. Benchmarks Y/Y

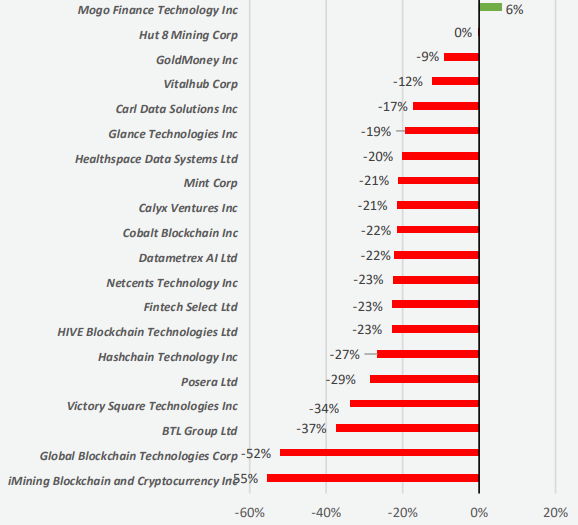

UBC20: Performance Distribution

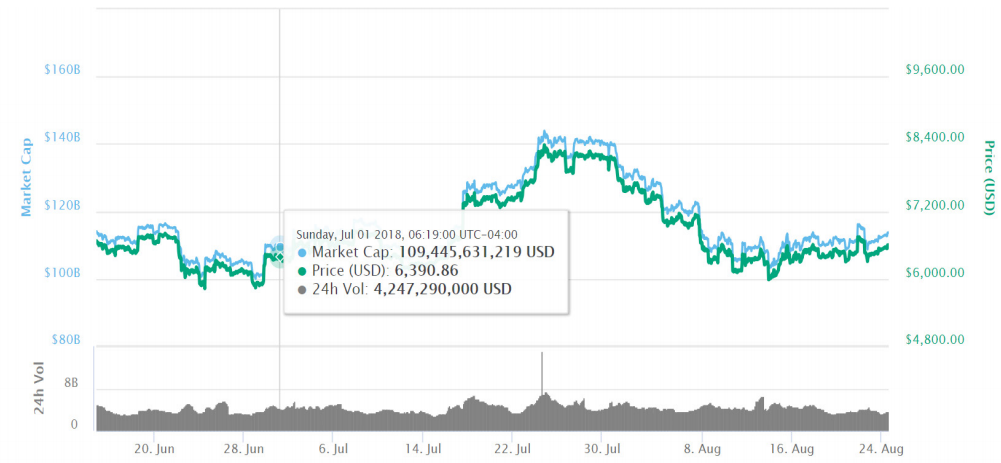

Bitcoin (BTC) Update

Bitcoin remains flat compared to its price as of our last report date. The crypto stayed at approximately US$6,500 between June 16 and July 16, before spiking to US$7,400 on July 17. It continued to rise for a week and stayed flat until the end of the month, until it began to decline again. Two significant declines on August 3 and August 7 dropped the price to US$6,400, where it has trended sideways since. BTC’s price volatility has reached an 11-month low, and it remains to be seen whether this will continue in the future, or whether Bitcoin will resume its historical behaviour as many enthusiasts expect.

Figure 1: Bitcoin Price Chart

Source: www.coinmarketcap.com

Source: www.coinmarketcap.comEthereum (ETH) Update

Ethereum has declined significantly since our last report date, where it had just dropped below US$500. Like Bitcoin, it declined somewhat after June 15 before recovering to US$500 by the same date the following month. ETH’s value has since consistently declined, including a drop from US$320 to US$255 on August 13. The currency currently sits at US$280. Significant alterations to ETH may be implemented soon. A “difficulty bomb,” which would would make Ethereum increasingly difficult to mine, as well as various measures against dedicated miners could be implemented in the near future, as an attempt to reduce the supply of ETH.

Figure 2: Ethereum Price Chart

Source: www.coinmarketcap.com

Source: www.coinmarketcap.comNotable Performers:

NetCents Technology Inc. (CSE:NC)

NetCents is a Canada-based online services company operating its payment processor and cryptocurrency. The Company’s stock price has jumped 44% since our last report date due to strong initial adoption of merchant cryptocurrency payments.

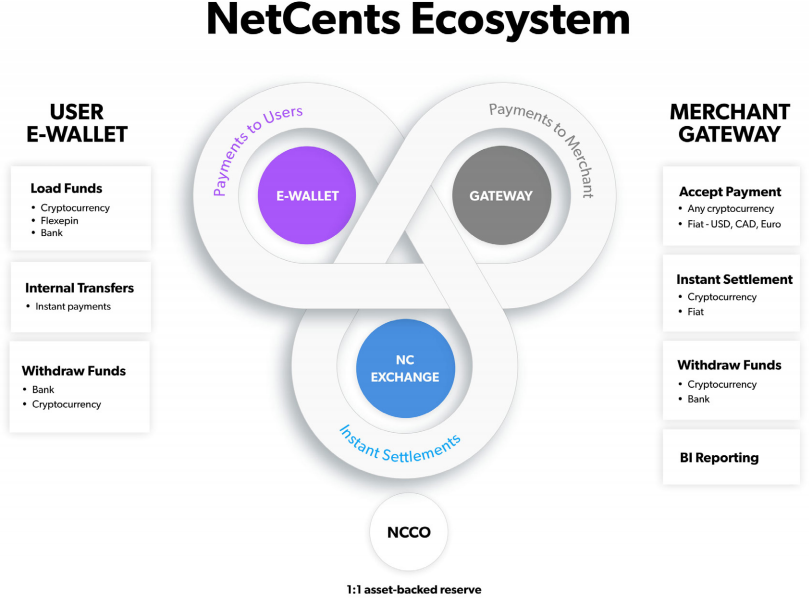

The Company operates three interconnected platforms. On the NC Exchange, users can buy and sell cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and the Company’s own cryptocurrency, discussed in more detail later. The Company’s user platform holds funds transferred from financial institutions, Flexepin, or cryptocurrency wallets, as well as from the NC Exchange. NetCents offers merchants a blockchain-based payment processor at a 2% transaction fee, with instant settlement and no chargeback losses. The Company’s payment processor takes funds from the user’s account and pays merchants in cryptos or fiat currency with no conversion cost. Below is a diagram of the Company’s ecosystem.

Figure 3: NetCents Platform

Source: Company Presentation

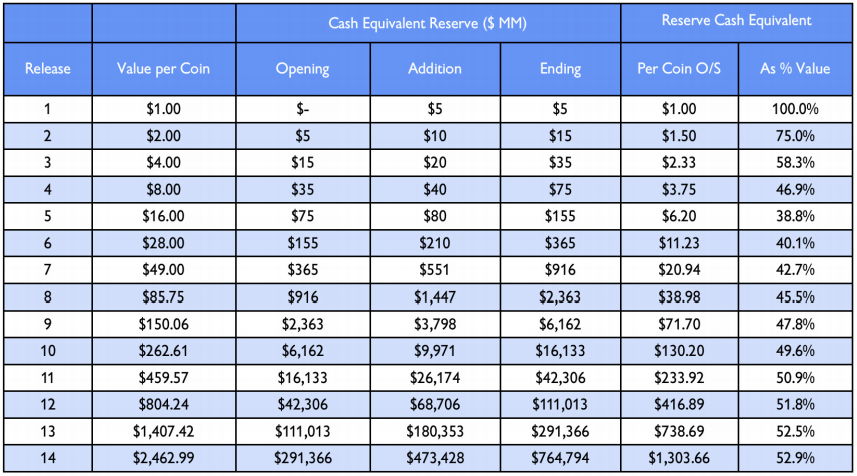

Source: Company PresentationFigure 4: Coin Value by Release

Source: NCCO Whitepaper

Source: NCCO WhitepaperOn April 20, the CSE announced the suspension of trading, due to the Company being in default of CSE continuous disclosure requirements. The British Columbia Securities Commission (BCSC) requested further information on the Company’s Q4 2017 and Q1 2018 filings, as well as information on the NCCO.

On July 13, the Company provided an update on its trade suspension. The Company refiled Q1 2018 and Q2 2018 statements and was in the process of establishing accounting standards for cryptocurrency coin sales. NC received an extension on the 90 day delisting deadline from the CSE.

On July 19, the Company established the NCCO Foundation. At the end of July, NetCents transferred all of its NCCO Coin IP to the Foundation, and a member of the Company’s board, Jean-Marc Bougie, stepped down to become Chairman of the Foundation.

On August 9, the Company launched Apple and Android apps, to access the Company’s platform. NetCents also provided an update on its trading halt progress, stating that it had refiled MD&As for Q4 2017, Q1 2018, and Q2 2018 at the request of the BCSC and responded to its comment letter.

On August 22, the Company announced the conclusion of the trading halt. Trading resumed on August 24. As trading resumed, the Company announced the launch of the NetCents card, a cryptocurrency credit card capable of interacting with all merchants that accept Visa (NYSE:V) and MasterCard (NYSE:MA). Over the course of the day, the Company’s stock fell 23%.

Glance Technologies Inc. (CSE:GET)

Glance Technologies is a software company providing payment solutions. The Company’s stock price fell 50% following its AGM and the sale of more than two million shares.

Glance Technologies provides payment solutions to clients primarily in the restaurant business. The Company’s Glance Pay app allows uses to pay restaurant bills without the need for a card machine. Users sign up for the free app to pay bills without waiting for a server, receive targeted coupons, and earn rewards from loyalty programs. The Company plans to implement order and pre-order features into the app. Restaurants receive expense tracking, rewards and records for bookkeeping purposes through Glance Merchant. The Company’s technology is currently patent-pending in Canada and the U.S.

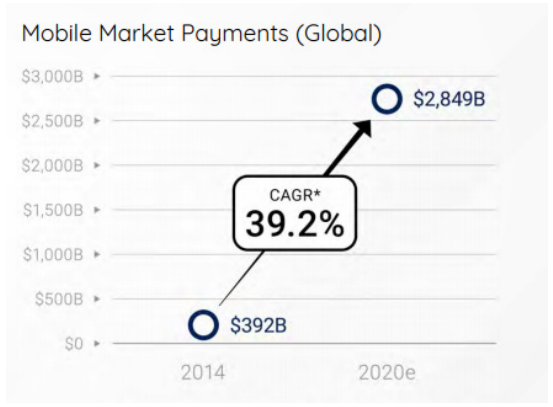

Since its launch, more than 500 merchant locations have signed up to use Glance Pay across North America. Glance’s technology makes the payment process more convenient for customers and increases turnover at restaurants. Research from Future Market Insights indicates robust growth at a 39% CAGR for the global mobile payments market between 2014 and 2020, as seen below.

Figure 5: Mobile Payments Market Growth

Source: Company Presentation

Source: Company PresentationThe Company is developing Glance Coin (GC), a cryptocurrency for use in its pre existing infrastructure.

A whitepaper was released recently, highlighting the specifics of how the currency will operate. GC will be distributed as a reward from its Pay app, and possibly from an Initial Coin Offering (ICO). Glance initially plans to roll out a decentralized loyalty marketplace, allowing users to trade GC on a peer-to-peer basis. Following the initial launch, the Company will release the external wallet, enabling GC to be publicly traded and converted into fiat currency. The diagram below illustrates the calculation and verification process of rewards on the decentralized ledger.

Figure 6: Glance Coin Distribution

Source: Glance Coin Whitepaper

Source: Glance Coin WhitepaperOn July 27, the Company released its Q2 2018 financial results. Glance signed 148 new locations and launched 59 others, the largest in Company history. Revenue increased 81% to $229,000. However, its operating loss grew 218%, due in large part to increased administrative, software development, and sales costs, as well as the expenses of the proxy contest. The Company’s stock price declined initially but recovered to its initial price by the end of the week. It has since risen 10%.

On August 16, the Company announced a partnership with Brewhound to integrate its Happy Hour app with the Glance Pay app. The Brewhound app provides users with deals at 650 locations in Vancouver.

On August 23, the Company began accepting merchants for the beta release of its new Glance PayMe app. The app is directed at merchants in the “gig economy,” who don’t have access to the payment solutions of larger vendors.

To read our full disclosure, please click on the button below: