Chris Thompson| Head of Research | Ubika Research | Chris@UbikaResearch.com| 1 (416) 574-0469

Patrick Smith | Analyst | Ubika Research | Patrick@UbikaResearch.com | 1 (647) 444-5506

Alp Erdogan | Analyst | Ubika Research | Alp@UbikaResearch.com | 1 (647) 479-5690

William Xiao | Associate | Ubika Research | william.x@gicpartners.com | 1 (647) 828-4632

Richard Waxman | Associate | Ubika Research | Richard@UbikaResearch | 1 (647) 770-2185

The Ubika Sustainability 20 Index (US20) slipped 6% since our last report but good natured Products Inc. (TSXV:GDNP) continues to outperform

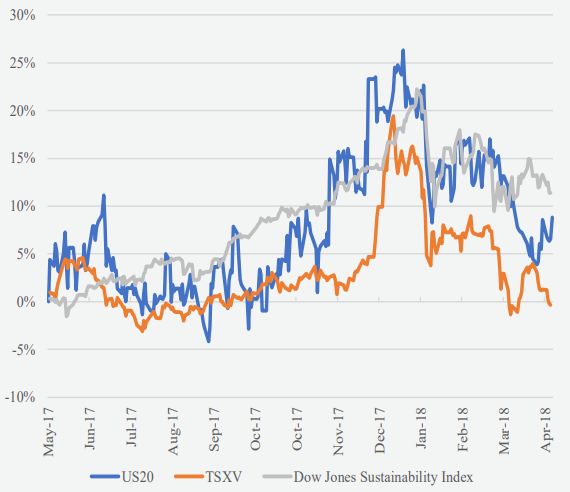

Ubika Sustainability 20 (March 12, 2017 - May 4, 2018)

US20: -6.3% (+8.4% Y/Y)

TSX Venture: -6.7% (-0.2% Y/Y)

DJSI – NA40: -4.1% (+12.5% Y/Y)

Dollar amounts in CAD unless otherwise stated.

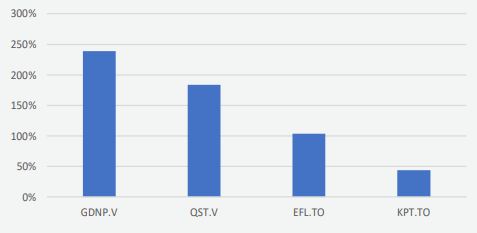

Top Volume Gainers (m/m)

All figures use price close as of May 4, 2018

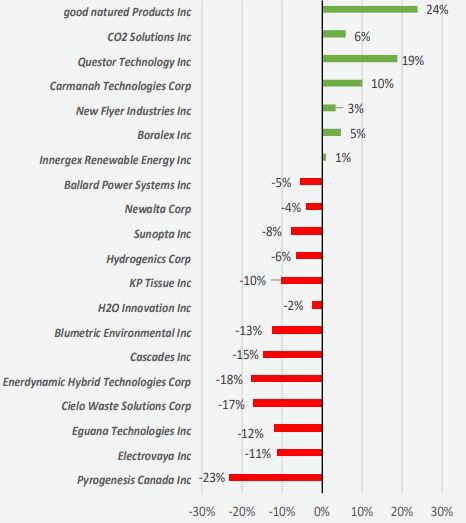

All figures use price close as of May 4, 2018The Ubika Sustainability 20 Index (US20) slipped 6% since our last report dated March 12, 2018, outperforming the TSX-V and underperforming Dow Jones Sustainability North America 40 indices, which declined 7% and 4%, respectively, over the same period. Notable performers for this report include:

- Carmanah Technologies (TSX:CMH), which climbed 15% with the release of its Q1 earnings.

- Boralex Inc. (TSX:BLX), which rose 5% with the acquisition of Kallista Energy and extension of its debt facilities.

- Eguana Technologies (TSXV:EGT), which fell 15% following the release of a customer’s product that contained EGT components.

Industry Highlights

Environment Commissioner Julie Gelfand says Canada will be unable to meet its UN mandated sustainable development goals. She has expressed concern over a clear lack of leadership and transparency in the five federal departments tasked with co-leading the implementation of the UN plan. This report stands in stark contrast to Prime Minister Trudeau’s speech at the UN last year, in which he described the government’s progress toward compliance with the UN targets as being closer to completion.

Ottawa has given estimates of the net effect of its new $50/tonne carbon pricing scheme, claiming that it can eliminate 90Mt of CO2 emissions by the year 2022. The government bases this claim on an analysis of how it anticipates human behaviour to react to the introduction of carbon pricing. The analysis supports the government’s previous claim that the new scheme will have a negligible effect on economic growth.

BC residents are increasingly prepared to protest pipeline construction. Kennedy Stewart, Member of Parliament for Burnaby South, commissioned a poll of BC residents that suggests up to 12% of British Columbians are currently willing to engage in civil disobedience to block Kinder Morgan’s pipeline construction – up 7% in the last six months. Opponents to the project contend that its completion will push Canada further from its climate change goals and increase the risk of catastrophic spills.

Upcoming Sustainability Events:

The Forum for Sustainable and Responsible Investment – Investing for a Sustainable World: May 30-June 1, 2018, Omni Shoreham Hotel, Washington DC. More than 400 CEOs, policy makers, fund managers and foundation representatives will attend this conference to learn about new developments and emerging trends in the field of sustainable investing.

Canada Green Building Council – Building Lasting Change: June 5-7th, Beanfield Centre, Toronto. Leading experts in green building design, government policy, real estate finance and technology, will come together for the 10th anniversary of Canada’s largest green building industry event. Developments in Canada and around the world will be examined through the lens of meeting aggressive international carbon emission targets.

US 20 Performance Vs. Benchmarks

US20: Performance Distribution

Notable Performers

Carmanah Technologies Corporation (TSX:CMH)

Carmanah Technologies is a Canadian renewables company that designs and distributes solarpowered illumination systems for infrastructure. The stock has returned 15% since our previous publication following the release of its encouraging Q4 2017 results on March 23, 2018..

The Company offers Light Emitting Diode (LED) signalling equipment that is used to illuminate airfields, obstruction buoys and traffic lights; solar-powered light panels for parking lots and highways; and on/off-grid solar power generation systems.

It has two operating segments: Signals (95% of FY 2017 revenue) and Illumination (5% of FY 2017 revenue). 92% of the Company’s FY 2017 revenue came from North America and Europe. The Signals segment includes the Company’s Traffic, Marine, Aviation, Offshore Wind, Telematics and Obstruction verticals. These products are often in remote locations and not connected to a reliable power grid. Furthermore, with improved cost/efficiency parity in solar-power technology, it is often more cost-effective and environmentally friendly to power infrastructure solutions such as street lights via solar power. The below image illustrates the Company’s different product offerings:

Figure 1: Carmanah Technologies Corporation Product Offerings

Source: Company Presentation

Source: Company PresentationIn July 2017, Carmanah completed its NZD $12M acquisition of marine solar-power LED rival, Vega Industries. Management’s aggressive integration plan for Vega is expected to deliver additional cost savings in 2018.

On March 20, 2018, Carmanah acquired a portfolio of patents related to traffic-control devices and rapid flashing beacons from Stop Experts, R.D. Jones for $2.4M. On the same day, a patent infringement claim that had originally been disclosed in 2013 was dismissed.

Carmanah’s stock price jumped 19% compared to its peer average of 5% in 2017. The Company’s stock price gained 7% in the week following the release of its Q4 2017 results. YoY revenue growth for FY 2017 was 9% (Q4 2017 – 32% QoQ). However, YoY EPS declined by 50% over the same period. This can likely be attributed to the Company’s 31% increase in R&D expenditures and its acquisition of Vega Industries. Margins are expected to improve over the next three years as solar panel production costs continue their trend of declining year-over-year. The Company anticipates LED performance to improve by 30% over the next three years to reach cost parity.

Carmanah has an average analyst price target of $4.48, representing a 7% downside. It currently has two Buy ratings and one Hold rating.

Boralex Inc. (TSX:BLX)

Boralex is a Canadian renewable power generation company with operations in Canada, The United States and France. Its stock has returned 5% since our last publication and less than 1% since the Company’s FY 2017 earnings release on February 18, 2018.

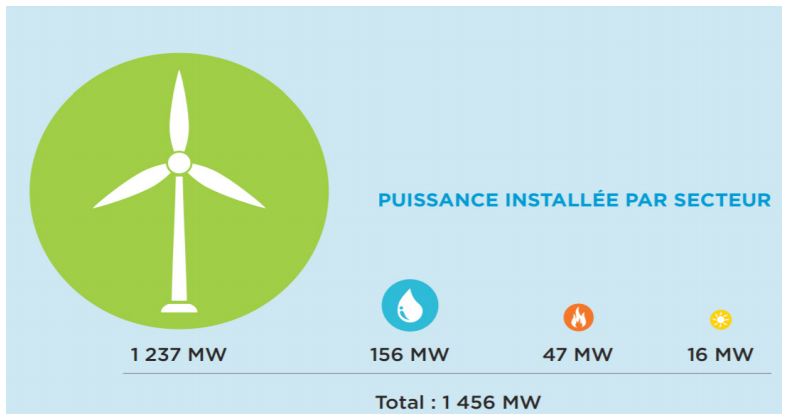

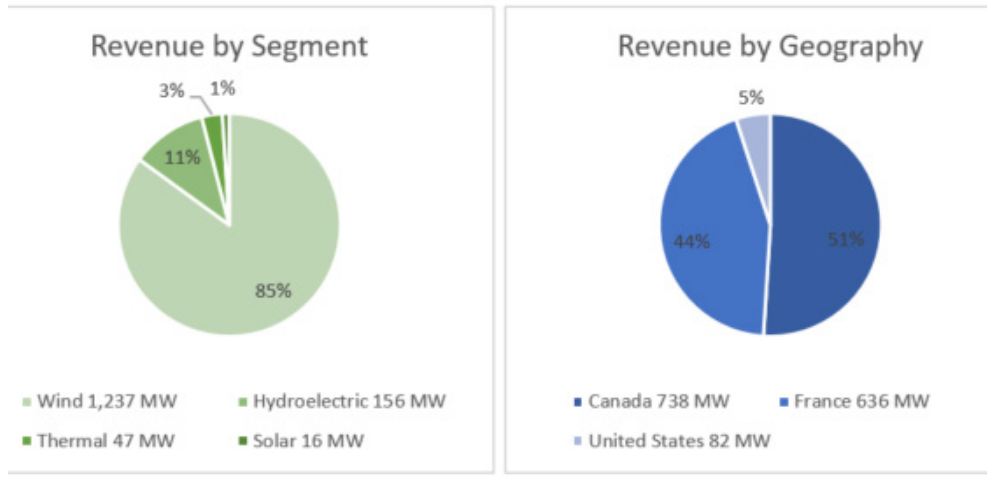

Boralex builds and operates power stations that generate electricity from wind, hydroelectric, thermal and solar sources. Its assets have a total capacity of 1,456 MW distributed amongst its operating segments, as shown in the charts below.

Figure 2: Boralex Inc. Power Portfolio & Revenue Breakdown

Source: Company Presentation

Source: Company PresentationOn March 29, 2018, Boralex announced it had extended the maturity of its $460M revolving credit agreement to 2022. A $100M accordion was also added to the facility.

On April 20, 2018, the Company entered into an agreement to purchase Kallista Energy for $349M at a 9.7x EV/EBITDA. The acquisition will be financed by existing debt facilities and will add 331 MW to Boralex’s wind portfolio. The acquisition will require Boralex to assume $147M in project debt. The Company’s stock price rose 2% following the announcement.

Boralex’s average analyst price target is $25.88, representing an upside of 10%. It is covered by nine analysts that have all assigned Buy ratings.

Eguana Technologies Inc. (TSXV:EGT)

Eguana Technologies is a Canada-based company that designs energy-storage solutions and powercontrol systems for grid-connected renewable energy applications. The stock has dropped 15% since our last publication.

Eguana products increase efficiency of existing infrastructure via power systems and controls and increase the renewable energy supply through storage and regulator solutions. They act as the “brains” of energy-storage systems by regulating power flow and enabling connection with the larger power grid.

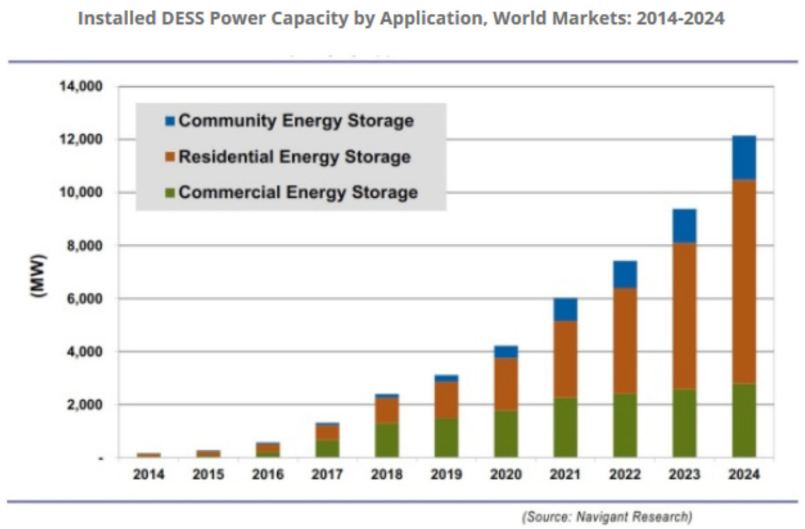

Products are designed from the ground up to suit residential, commercial and battery developer customers. Residential products are focused on grid-interactive energy storage solutions that connect to a home’s solar panels. The fully-automated battery systems regulate consumption for optimized performance. Commercial products are upscaled, modular, versions of the same technology used in residential offerings, while its battery developer products utilize its patented “Bi-Direx” technology to help manufacturers design custom tailored storage solutions around their The Company has a strong patent portfolio and invests heavily in R&D. As the early market leader, it is well positioned to capture market share of the growing distributed energy storage systems (DESS) market, which is expected grow to US$16.5B by 2024 according to Navigant Research, as seen below.

Figure 3: Distributed Energy Storage System Capacity Growth

Source: Company Presentation

Source: Company PresentationInitial shipments have generated $1.3M in revenue as of Q1 2018, a 389% increase over the same period last year. However, with a gross margin of 16%, EGT is still well below its industry average of 37%.

On March 14, 2018, Streetwise published a positive research report about Eguana. The Company’s stock price fell 12% the following week in response.

On March 22, 2018, Eguana launched a new AC battery unit for small commercial and electric vehicle applications. Its stock price rose 9% in response.

On April 24, 2018, Eguana customer EdgePower launched a new product that included Eguana’s commercial AC batteries. Eguana’s stock price eased 5% on the day of the announcement.

The Company’s analyst price target is $0.70, representing a 218% upside. The only analyst to cover Eguana has issued a Buy rating.

Upcoming Catalysts:

Regulatory challenges and opportunities are on the horizon for renewable energy companies. National debates on carbon pricing continue in Canada, while the US Environmental Protection Agency (EPA) appears to be moving away from regulatory initiatives. Companies like Eguana have been benefiting from reduced permit requirements in localized jurisdictions that it hopes will translate into widespread adoption and sales growth.

Self-driving vehicles are expected to take over the trucking industry over the next decade and companies are already striving for the most cost-efficient designs. On May 3, 2018, AnheuserBusch (NYSE:BUD) ordered 800 hydrogen-electric semi-trucks from Tesla (Nasdaq: TSLA) rival, Nikola Motors. Designs based around hydrogen fuel have not had as much attention as electric designs. However, they often have much longer ranges (1,900 km vs 800 km for Tesla) making them well suited for long-haul jobs. A resurgence of hydrogen fuel may be brewing.

To read our full disclosure, please click on the button below: