Chris Thompson| Head of Research | Ubika Research | Chris@UbikaResearch.com| 1 (416) 574-0469

Patrick Smith | Analyst | Ubika Research | Patrick@UbikaResearch.com | 1 (647) 444-5506

Alp Erdogan | Analyst | Ubika Research | Alp@UbikaResearch.com | 1 (647) 479-5690

William Xiao | Associate | Ubika Research | william.x@gicpartners.com | 1 (647) 828-4632

Ubika Sustainability 20 (May 7, 2018 - June 22, 2018)

US20: 7.3% (+14.7% Y/Y)

TSX Venture: -2.4% (-1.9% Y/Y)

DJSI – NA40: 2.1% (13.0% Y/Y)

Dollar amounts in CAD unless otherwise stated

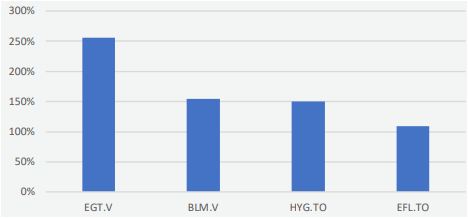

Top Volume Gainers (m/m)

Ubika Sustainability Index sees Two Penny Stocks Blossom

The Ubika Sustainability 20 Index (US20) increased 7.3% since our last report dated May 7, 2018, outperforming its two benchmarks, the TSX-V and Dow Jones Sustainability North America 40 indices, which fell 2.4% and rose 2.1%, respectively, over the same period. Notable performers for this report include:

US 20 Performance Vs. Benchmarks

US20: Performance Distribution

Industry Highlights

- Parliament has passed a carbon tax bill. Any provinces without a higher carbon tax or cap-and-trade system would have a $20/t tax imposed beginning 2019, rising to $50/t in 2022. Currently, Alberta, BC, Quebec, and Ontario already have higher taxes, but the incoming Ontario Progressive Conservative government plans to scrap its existing cap-andtrade program and challenge the federal bill. The projected impact of the tax on emissions is shown below.

Figure 1: Emissions Decline over Time with Federal Carbon Tax

Source: Environment Canada Website

Source: Environment Canada Website- The incoming Ontario PC government also plans to stop the GreenOntario program, which provided Ontarians rebates on solar power, heating, and smart thermostats. The program began in 2017, and was funded by the cap-and-trade program. Other environmental programs, such as the Green Energy Act, may also be cut by the new administration.

Upcoming Sustainability Events:

EV Infrastructure Summit, July 3-4, London, UK. The conference hosts OEMs, municipal planners, and investors aiming to improve European EV infrastructure as Europe progresses towards 8M EVs by 2020.

Notable Performers

Cielo Waste Solutions Corp. (CSE:CMC)

Cielo Waste Solutions is an alternative fuels company producing renewable diesel from offtake products. The Company has risen 26% since our last report date due to its new provincial permit.

Cielo Waste Solutions is advancing its waste-to-diesel technology. The technology, exclusively licensed from an Alberta company, uses multiple input sources usually considered as waste products, such as sawdust, plastics, tires, construction debris, and other organic and solid waste. Cielo pays the company a royalty fee, and holds purchase rights on the IP. Using the technology, CMC produces high-grade, long-life renewable diesel, expected to sell at a premium to biodiesel despite lower production costs. Below is a comparison of biodiesel and renewable diesel costs and prices.

Figure 2: Biodiesel vs. Renewable Diesel

Source: Company Presentation

Source: Company PresentationFigure 3: Cielo Plant EBITDA Projections

Source: Company Presentation

Source: Company PresentationOn April 23, Cielo announced the receival of its draft Environmental Protection and Enhancement Act (EPEA) permit.

On June 6, the Company announced a warrant exercise incentive program. It also announced the approval for submission of a Bioenergy Producers Program grant application, which could subsidize $0.13/l of production. Following the announcement, the Company’s stock price declined from $0.16 to $0.13.

On June 11, the Company announced its full EPEA permit had been received. The Company expects to complete assembly of its plant by the end of June. CMC’s stock price rose from $0.14 to $0.22, and has currently corrected to $0.18.

good natured Products (TSXV:GDNP)

good natured Products is a Canada-based bioplastics company. The Company’s stock price has climbed 8% since our last report date as it acquired a major American client.

The Company creates bioplastics products, aimed primarily at packaging, producing more than 100 food packaging designs, 10 grades of rollstock sheets, and 30 home & business organizational products. Below is a chart showing the Company’s product categories and the market segments it targets.

Figure 4: goodnatured Product Categories

Source: Company MD&A

Source: Company MD&AThe Company develops and designs new bio-based products, often in collaboration with leading Canadian R&D groups, while its sourcing teams look for more advanced plant and bio-based materials. The resulting Intellectual Properties (IPs) are aimed at increasing plant-based percentages, material performance requirements, or meeting market-pricing objectives. In addition to developing their own materials, the Company licenses plant-based materials IPs from other companies, using the material as packaging or as an ingredient.

On April 26, the Company released its FY 2017 earnings report. The Company’s fiscal year was changed to December end, as opposed to February as before. Revenue increased 20% from FY2016 to FY2017, and 51% if January and February 2018 are included. The Company’s stock price rose from $0.11 to $0.14 by the end of the month.

On May 2, the Company announced a 40-month agreement with a U.S. industry leader in thermoformed packaging. The Company expects the agreement to return US$1M at a 30-32% gross margin within the current year. GDNP’s stock price corrected $0.02, from $0.14 to $0.12.

On May 15, the Company released its Q1 2018 earnings report. Highlights include a 62% increase in revenue over the prior-year period, a 4% increase in gross profit as a percentage of sales, and a 14% decrease in sales, general, and administrative expenses. The Company’s stock price added $0.01.

Upcoming Catalysts:

Tesla (NYSE:TSLA) aims to ramp up production of its Model 3 car, a relatively low-cost allelectric vehicle. If successful, this development could hasten the predicted rise in electric car use. However, the Trump administration plans to freeze car emissions standards in 2020, which could enable conventional automobile manufacturers to outcompete their more sustainable models.

Following the federal government’s purchase of the Trans Mountain pipeline, environmental activists have pledged to increase protests against the construction of the pipeline, and the BC government continues to challenge the pipeline in court. Negotiations involving the pipeline could grant the NDP/Green government various environmentally-oriented concessions, or possibly even prevent construction entirely.

To read our full disclosure, please click on the button below:

Html code here! Replace this with any non empty text and that's it.