Abaxx Technologies Inc (NEO:ABXX) is looking to create the world’s first LNG contract that gets settled in physical gas

Keith Schaefer, Investing Whisperer | March 16, 2022 | SmallCapPower: The disaster unfolding in Europe this week is unearthing a whole host of problems with our energy system.

(The following article was originally published on investingwhisperer.com)

Not the least of these is that we clearly need more Liquified Natural Gas (LNG) capacity.

Oil has grabbed the headlines this week, but for the last 4 months LNG had taken center stage. The dependence of the EU on Russian gas has limited sanctions and forced Europe to sit idly by as Putin does what he wishes.

It is clear we need alternatives and renewables are not there yet. The only way to fill the gap is with LNG. The world needs LNG even more if 7 million barrels a day of Russian oil gets embargoed!!!

Abaxx Technologies Inc. (NEO:ABXX) is looking to create the world’s first LNG contract that gets settled in physical gas; not an accounting ledger. It will be out of Singapore and has high profile backers like Kyle Bass and Robert Friedland.

These commodity exchanges are more profitable than stock exchanges. If CEO Josh Crumb has bet right and LNG is The Next Big Fuel, then Abaxx will be a cash cow for investors.

Think of Abaxx as trying to do for LNG what Brent crude did for oil.

Now, that’s enough upside, but TODAY, their spin-out Base Carbon Inc. (NEO:BCBN) has its IPO, and Abaxx owns 19.7% of BCBN. Depending on how that stock trades, it will add a lot of value to Abaxx.

QUICK FACTS

Trading Symbols: ABXX

Share Price Today: $2.50

Shares Outstanding: 71 million

Market Capitalization: $205 million

Net Debt: -$30 million

Enterprise Value: $175 million

There was a time, not so long ago, when Brent crude was not a thing. There were local benchmarks – WTI was the biggest and most liquid – but if you wanted to peg the value of seaborne crude oil you needed to place a call to the traders on either end.

Those days are long gone and now Brent is by far the bigger contract. Two-thirds of all oil is priced in Brent.

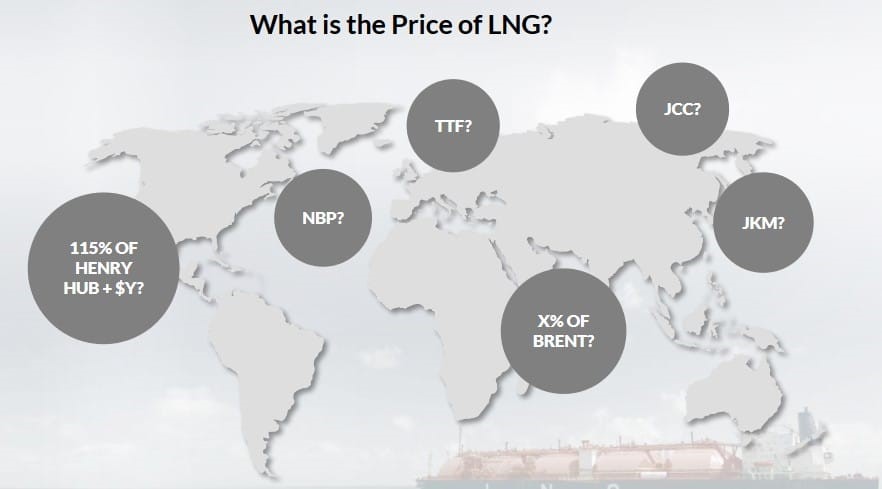

Today, we have a similar set-up in LNG.

Source: Abaxx November Investor Presentation

We have local prices and benchmarks that are cobbled together from traders. But there is not a true LNG exchange traded market.

Abaxx is looking to change all that.

Building an LNG Exchange

Building an exchange isn’t easy. Abaxx has spent 3 years and $25 million getting together the regulatory licenses, arranging clients, and building the software.

Abaxx has a system that is ready to trade right now. The last, remaining step is getting integrated with a prime broker. These are the banks that will act as the intermediary in the exchange and facilitate the trades.

It is this final step that has been holding Abaxx back. They need to coordinate multiple global banks to be ready to launch.

That means getting large, monolithic banks to prioritize IT changes, integration of the exchange to their backend, and do the myriad of assurance and acceptance testing. It takes time.

The other time hog has been their vision. Abaxx is building more than an exchange – they are putting together both the front and back end, and that means a clearinghouse too.

Getting a clearinghouse approved means more regulatory and more hoops. Abaxx received notification that their clearinghouse was approved in principle by the Monetary Authority of Singapore in August.

Building the clearinghouse is a barrier to entry and creates a moat for Abaxx. It means that for every transaction done, Abaxx does not have to defer to a third party for clearing. They can do that themselves.

What will set Abaxx apart from other exchanges that trade LNG futures is that Abaxx products will be physically settled rather than cash settled contracts.

It is a big difference for an end user or producer. One is an accounting settlement where cash exchanges hand. The other is physical delivery of the gas.

On their update call on February 22nd, Abaxx was asked in the Q&A when they would be up and running. They didn’t give a date. It tells me there is still work to be done.

Commodity Exchanges Are Very Lucrative

What we do know is that once the exchange is in operation, it should be a cash cow.

Exchanges make money off volume. Every transaction through the system, Abaxx will take a tiny cut.

The LNG market is BIG. Abaxx estimates that by 2030 the LNG physical market will be about 320 million tonnes per year (this is an estimate from Morgan Stanley).

At $10 per mmbtu that works out to an addressable market of $150 billion in gross volume.

From that level of trade, Abaxx estimates their addressable market in terms of revenue potential at about $500 million

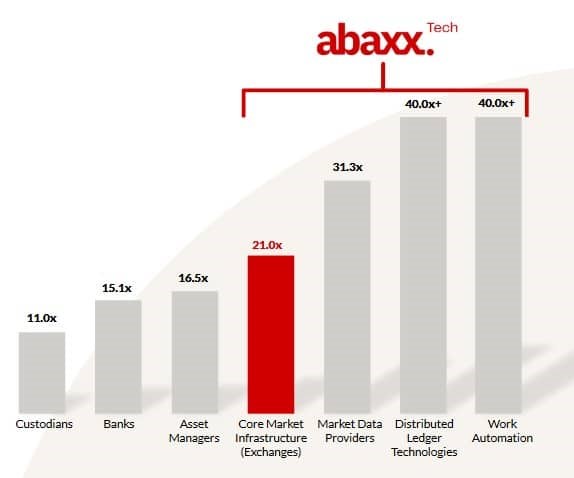

Source: Abaxx November Investor Presentation

Exchanges typically get nice multiples. Abaxx highlights that the average P/E for exchanges is about 21x 2021 earnings.

Source: Abaxx November Investor Presentation

Taking a closer look at some of the North American exchanges, CME Group (CME – NYSE) trades at 31x P/E, the Intercontinental Exchange (ICE – NYSE) trades at 21 x P/E and Nasdaq (NDAQ – NASDAQ) trades at 20x P/E.

Each of these exchanges is a cash cow – their free-cash-flow yield range from 4-6%.

Of course, these are all established and far, far larger names. The market cap ranges from $25 billion for the Nasdaq to $85 billion for CME Group. Abaxx has a market cap of $200 million.

That difference is telling you that Abaxx still has a long road ahead. But the prize – being the first to market with exchange traded LNG – sure looks attractive.

LNG as a Stepping Stone to Carbon

Getting the exchange and clearinghouse off the ground is really just Step One. The bigger picture here is to introduce new contracts for a wide range of commodities.

On their February 22nd investor call Abaxx described how much easier it will be to launch subsequent products once they have their own exchange and the clearinghouse operating.

“This [exchange clearinghouse] will allow us to move quickly and control that whole process, the marginal efforts to launching our next products are so much less than getting a whole ecosystem off the ground.”

One of those next-to-market products will almost certainly be carbon.

Abaxx just finished the distribution of 5 million shares of their subsidiary Base Carbon to shareholders.

Base Carbon is putting together a voluntary carbon market contract.

The idea evolved from Abaxx’s own potential customers. Being involved with LNG, many of them are worried about global warming and (more personally) what it means for their business.

A time will come, probably not too long from now, where imports of an LNG cargo into Japan or the EU will require an offset to its carbon footprint at the same time.

Hearing these concerns, Abaxx looked at the options and quickly realized they were limited.

They identified the problem – there weren’t enough reforestation projects out there to make a dent.

Abaxx set to work to put together a standardized carbon offset. Basically, it’s a carbon contract that represented a set tonnage of carbon being removed from the atmosphere; a contract that could be used to offset carbon producing assets.

Out of this recognition, Abaxx created their Base Carbon subsidiary.

After the share distribution Abaxx still holds 19.7% ownership in the business.

In addition, Abaxx shareholders will participate in Base Carbon through royalties. Abaxx will get a 2.5% royalty on carbon credits that Base Carbon sells.

Why Spin-Out Base Carbon

If Base Carbon fits so well with the exchange, why sell it?

There are a few reasons.

First, Abaxx believes that Base Carbon could generate a lot of excitement from investors. They don’t want that muddled with the mechanics of getting an exchange up and running.

Second, the business is bound to be capital intensive. Abaxx expects that to get to scale Base Carbon will be raising $100’s of millions in capital. They don’t want to dilute the LNG business as they do this.

Third, Abaxx wants to keep their stock a pure play on the exchange. Base Carbon complicates the structure and, once everything is operating, the financials as well.

Base Carbon was cashed up in November when Abaxx did a $50 million offering of shares. Abaxx owns 19.7%.

Timing for LNG Exchange Could Not be Better

Over the last couple of weeks the world has changed – maybe forever.

Abaxx is one of the few companies that are on the right side of it. We need more LNG.

Even before Russia invaded Ukraine, LNG forecasts were being ratcheted up. Shell’s LNG outlook, released late last year, estimated that LNG demand would nearly double by 2040.

Their forecast was mainly based on increasing demand from Asia. You can add Europe to that mix now.

Germany did a 360° just this week, announcing they want 2 LNG import projects built as soon as possible. Other countries will follow the lead.

At the end of the third quarter Abaxx had $30 million of cash and equivalents available. They spend around $1 million a month. Now they will have just under 20% of BCBN’s market cap that they can mark to market each quarter.

It’s a very low burn rate and it gives them enough cash runway to get the exchange up and running.

I like the space and I like the progress Abaxx has shown so far. My only question is when does the exchange start generating cash?

I don’t have an answer for that. It looks like there are still some hurdles to overcome.

I’ll be watching this one closely to see if they can clear them.

DISCLOSURE—I AM LONG ABAXX AND BASE CARBON

To read our full disclosure, please click on the button below: