Production of battery metals such as graphite, lithium and cobalt will need to ramp up in a big way

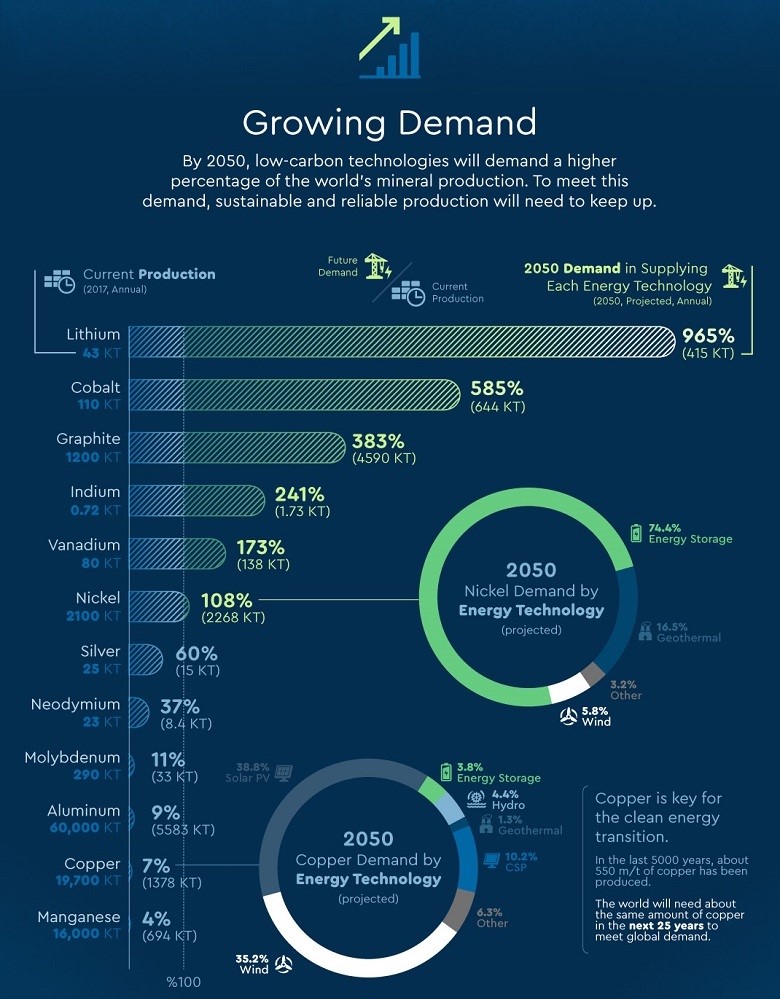

Cecilia Jamasmie, Mining.com | May 19, 2020 | SmallCapPower: Production of so-called battery metals, such as graphite, lithium and cobalt, will have to increase by nearly 500% by 2050 to meet the growing demand for clean energy technologies, the World Bank said on Monday.

(The following article was originally published on mining.com on May 11, 2020)

According to the global lender, over 3 billion tonnes of minerals and metals will be needed to deploy wind, solar and geothermal power, as well as energy storage required for transitioning to a low-carbon economy.

Many of the critical minerals used to make batteries for electric vehicles are found in developing nations. The World Bank’s goal is to help those nations to mine those commodities in a sustainable way to avert major ecological damage.

Mining the vast amount of key commodities the world will need in 30 years is seen as the only path to achieving the goals of the Paris Agreement. The accord seeks to limit global warming to 2°C or less.

Source: World Bank 2019.

Source: World Bank 2019.

Getting to that point, the World Bank said in a new report, will require global carbon emissions of greenhouse gases to be deeply reduced by 50% by 2030 and to net-zero by 2050.

The latest findings confirm the premise of a report published in 2017, which warned that the more ambitious the climate targets become, the more minerals and metals will be needed.

While renewables and energy storage technologies require more minerals, the carbon footprint of their production — from extraction to end-use — would account for only 6% of the greenhouse gas emissions generated by fossil fuels, the study said.

The Minerals for Climate Action report also calls for more recycling and reuse of minerals, saying it will play a key role in meeting increasing mineral demand.

It also noted that, even if recycling rates for minerals like copper and aluminum are scaled up by 100%, recycling and reuse would still not be enough to meet the demand for renewable energy technologies and energy storage.

Virus ambush

Some minerals, like copper and molybdenum, will be used in a range of technologies, the report noted. Others, such as graphite and lithium, may be needed for just one technology: battery storage.

That means that any changes in clean energy technology deployments could have significant consequences on demand for certain minerals, it said.

The lender warned about the disruptions COVID-19 is causing and will continue to trigger in the global mining industry.

In addition, developing countries that rely on minerals are missing out on essential fiscal revenues.

As their economies start to reopen, the bank said, they will need to strengthen their commitment to climate-smart mining principles and mitigate any negative impacts.

“COVID-19 could represent an additional risk to sustainable mining, making the commitment of governments and companies to climate-smart practices more important than ever before,” said Riccardo Puliti, World Bank Global Director for Energy and Extractive Industries and Regional Director for Infrastructure in Africa.

“This new report builds on the World Bank’s long-standing expertise in supporting the clean energy transition and provides a data-driven tool for understanding how this shift will impact future mineral demand,” he said.

The World Bank’s predictions echo a February report by Moody’s, which indicated that green, social and sustainability bond issuance is expected to hit a combined record of US$400 billion in 2020 alone. That’s up 24% from the previous record of US$323 billion achieved in 2019.

To read our full disclosure, please click on the button below: