In comparison to its peers, Advantage Oil & Gas (TSE:AAV) appears to be best all-around with hedging, low debt, and competitive production costs

Jassie Bhyathal | March 10, 2017 | SmallCapPower: The recent surprise build up in natural gas inventories made history, as it was the earliest injection ever recorded since the Energy Information Association (EIA) began reporting data. As a result, the price of natural gas plunged nearly 20% as the worst of winter is behind us and heating demand is diminishing. Heading into the shoulder season, when natural gas inventories switch from withdrawals to injections to build inventory for next winter, we compare a key small-cap producer against its peers (with a 90% or higher production mix of natural gas to oil), to see which company is best positioned to surge from rising natural gas prices.

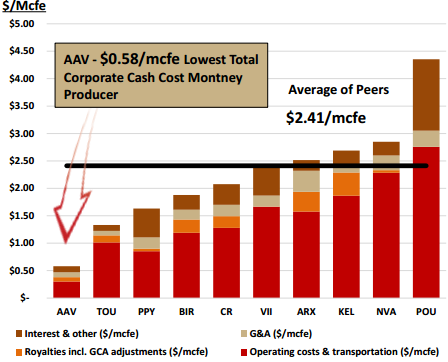

A company that has caught our attention is Advantage Oil & Gas Ltd. (TSX: AAV) (“Advantage”), a pure-play with a production mix of 95% natural gas, with the lowest operating costs in the world-class Montney region (see Figure 1 below). What intrigues us most about Advantage is its lean operations and organic growth strategy, as well as the fact that it is one of the only producers that owns and operates all of its plant and infrastructure needs. With the volatility in natural-gas markets, Advantage has significant risk management hedges in place to protect future cash flows and maintains one of the strongest balance sheets in the industry with a FY2016 debt-to-cash flows of 1.0x, compared to a peer average of 3.0x.

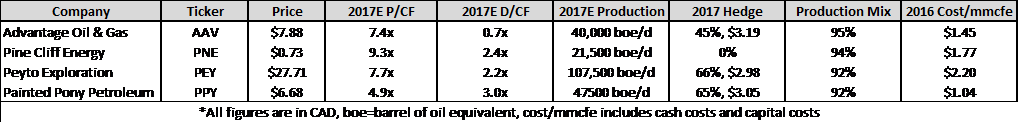

Figure 1: Montney Natural Gas Producers

SOURCE: Advantage Oil & Gas Corporate Presentation

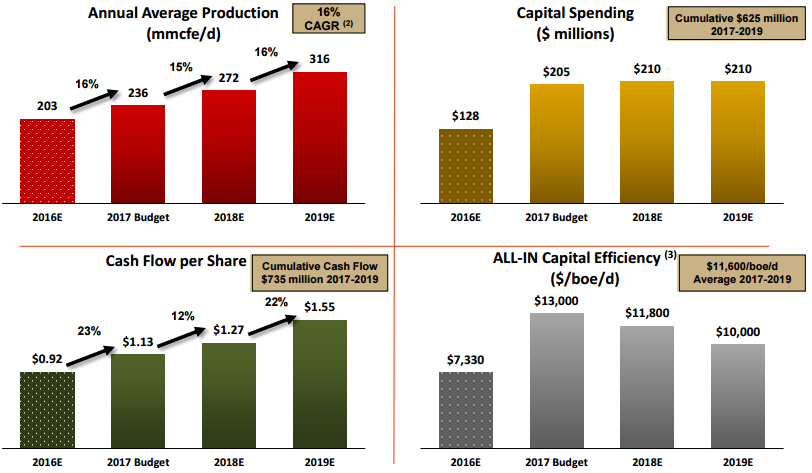

Presently, the Company has a three-year growth plan to boost production by 56% from 221 to 325 mmcfe/d (million cubic feet equivalent per day) funded entirely from its cash flows. In fact, with an average AECO price of @2.95 MCF, the Company will have $110mm cumulative cash surplus over the lifetime of the project development. To support this growth, Advantage plans to expand its plant processing to 400 mmcfe/d, complete 19 wells, and has hedged its future production. Worse comes to worst, the Company has an undrawn $247mm credit facility that offers significant financial flexibility.

Figure 2: Advantage Oil & Gas’ Growth Plan

SOURCE: Advantage Oil & Gas Corporate Presentation

Over the last three years, Advantage has increased annual production by 74% to 203 mmcfe/d and reduced operating costs per mmcfe by 44% to $0.27 in 2016. This astounding track record and management experience creates a strong foundation for Advantage Oil & Gas’ continued industry leading low-cost structure and makes its current expansion project virtually risk free. Led by CEO Andy Mah, Advantage is well positioned to benefit from not only higher natural gas prices, but also increasing production and management’s ability to continuously improve and lower operating costs.

Currently trading at a price to forward cash-flows of 7.4x, Advantage appears to be trading in line with industry peers (please see Figure 3). Although Painted Pony Petroleum Ltd. (TSX: PPY) appears undervalued with lower production costs and a forward P/CF of 4.9x, it is riskier with trailing 2017 debt to cash flows of 3.0x versus Advantage’s 0.7x. In comparison to its peers, Advantage appears to be the best all-around conservative growth investment with hedging, low debt, and competitive production costs. Having said that, Advantage Oil and Gas is worth keeping an eye on, as lower natural gas prices in the shoulder season may lead to a more attractive valuation and a promising long-term investment.

Figure 3: Peer Junior Oil & Gas Analysis