Patrick Smith | Analyst | Ubika Research | Patrick@UbikaResearch.com | 1 (647) 444-5506

Richard Waxman | Associate | Ubika Research | Richard@UbikaResearch.com | 1 (647) 770-2185

Gold stocks continue to struggle on further U.S. dollar strength

Ubika Gold 20 (May 14, 2018 - July 03, 2018)

UG20: -4.5% (-8.4% Y/Y)

Gold Price: -5.4% (1.7% Y/Y)

TSX Gold Index: 0.4% (-9.1% Y/Y)

Dollar amounts in CAD unless otherwise stated.

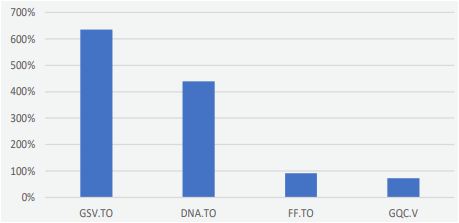

Top Volume Gainers (m/m)

The Ubika Gold 20 Index has declined 4.5% since our last Gold Report on May 14, 2018. It outperformed the gold spot price over that period, which decreased 5.4%, but underperformed its TSX/S&P Global Gold Index benchmark which rose 0.4%. Some notable performers from the index were:

- Dalradian Resources Inc. (TSX:DNA, LSA:DALR), which increased 41% on news of a takeover offer by Orion Mine Finance.

- Alamos Gold. (TSX:AGI, NYSE:AGI), which increased 12% on news that it would be expanding one of its mining operations.

- Pretium Resources. (TSX:PVG), which increased 6% on news that it would expanding its flagship mining property.

Industry Highlights:

- Investors are increasingly concerned about a trend of one-time settlement payments from gold companies to governments of African countries. Glencore’s recently announced $150M payment to the Democratic Republic of Congo is the latest in a series of such settlements that are raising concerns that companies in Africa are operating on the fringes of regulatory frameworks.

- Gold prices approached a 12-month low in the last week of June 2018. Spot prices fell from US $1,300/oz on June 14, to as low as US $1,253/oz on June 27.

UG20: Performance Vs. Benchmarks Y/Y

UG20: Performance Distribution

Upcoming Events:

North American Mining Expo – September 12-13, 2018. Sudbury, Canada. A major event for showcasing environmental services, lube products, powder, minerals, etc. 5000 attendees and more than 300 exhibitors are expected to be in attendance.

Notable Performers

Dalradian Resources Inc (TSX:DNA, LSE:DALR)

Dalradian Resources is an exploration and development company with property assets in Northern Ireland. The Company’s stock climbed 41% since our last report, dated May 14, 2018.

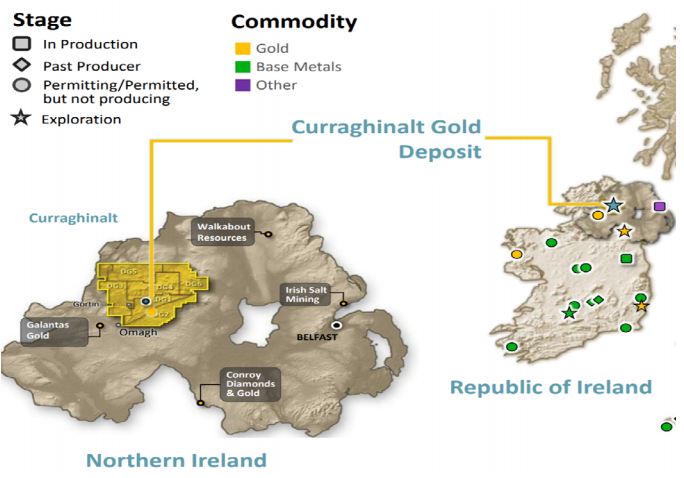

Dalradian Resource’s flagship property, the Curraghinalt Project in Northern Ireland, consists of a series of 21 structurally controlled, high-grade gold bearing quartzcarbonate veins with over 2.3km of strike, open in all directions. As of May 2018, 130,000 metres of drilling and underground development had been completed. The property hosts Mineral Resources of 33,000 ounces Measured, 3.0M ounces Indicated, and 3.1M ounces Inferred. The underground drilling program is meant to support an ongoing Feasibility Study, expected to produce updated values in Q3/2018.

The Company expects to spend the remainder of 2018 in the permitting process, consulting with local officials and regulators. Thus far, Dalradian has completed more than 70 site visits and 40 meetings with regulators. Figure 1 outlines the status and location of gold projects in Ireland.

Figure 1: Dalradian Gold Projects in Ireland

Source: Dalradian Company Presentation

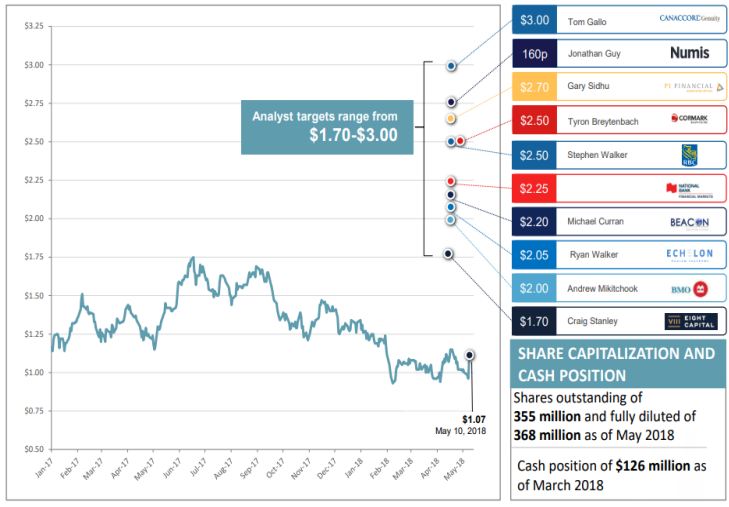

Source: Dalradian Company PresentationFigure 2: Dalradian Price Targets

Source: Dalradian Company Presentation

Source: Dalradian Company PresentationAlamos Gold Inc. (TSX:AGI, NYSE:AGI)

Alamos Gold is an intermediate gold producer with operations in Canada and Mexico. Alamos has three mines in production with another operational mine acquisition pending. The Company’s stock price ained 12% since our last report on gold, dated May 14, 2018.

AGI’s flagship Young-Davidson mine is situated on an 11,000-acre property in northern Ontario, ~60 kilometers west of Kirkland Lake. The project started as an open pit mine and transitioned into an underground mine later in its reserve life. The mine hosts mineral reserves of 43.2M t grading 2.65 g/t Au for 3.7M oz. (December 2016). The Company expects Young-Davidson to produce 200,000 to 210,000 oz. in 2017 at cash costs of US$625/oz (AISC of US$775/oz).

AGI’s latest pending acquisition, Richmont’s Island Gold mine, comprises a 7,700-hectare property in Ontario, 83 kilometers northeast of Wawa. The underground mine has produced 500,000 oz of gold since October 2007. Additionally, the mine hosts Mineral Reserves of 2.6Mt, grading 9.17 g/t Au for 752K oz. (December 2016). In 2017, Richmont expected the Island Gold mine to produce 87,000 to 93,000 oz., at total cash costs of US$550/oz. to US$590/oz. (AISC of US$725/oz. to US$765/oz.). Additionally, the Company plans to expand operations and lower costs at the Island gold mine, raising production to ~125,000 oz., while lowering AISC from US$881/oz. to US$550/oz. (PEA, July 2017).

AISC for all of the Company’s operations is projected to be US $950/oz with total gold production of 490,000-530,000 oz.

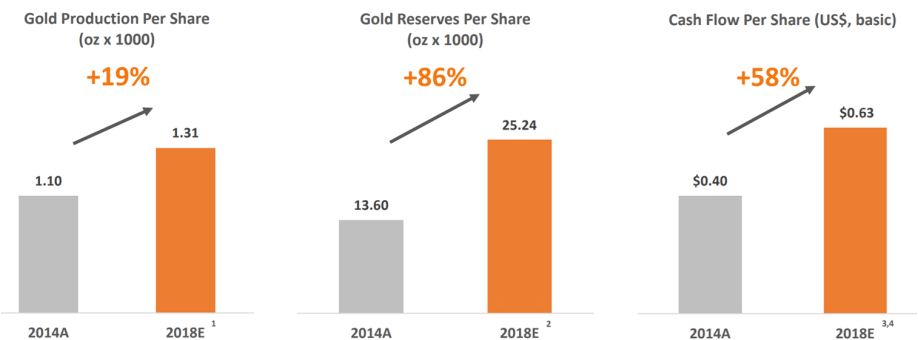

Figure 3 outlines the Company’s expanded growth profile into 2018.

At the end of 2017, the Company’s 2P reserves were estimated to be 203,399,000 tonnes at a grade of 1.50 g/t, or 9,832,000 oz.

Figure 3: Alamos Growth Projections

Source: Alamos Company Presentation

Source: Alamos Company PresentationAlamos is covered by 15 analysts with an average price target of $11.44. This represents an upside of 53%. It currently has 13 Buy ratings and 2 Hold ratings.

Pretium Resources Inc. (TSX:PVG)

Pretium Resources is a Tier II producer with operations in Western Canada. The Company’s flagship asset, the Brucejack mine, began commercial operations in Q2/2017. Pretium’s stock price rose 6% since our last report, dated May 14, 2018.

Pretium’s Brucejack mine is an underground operation located in northwestern British Columbia, ~65 kilometers north of Stewart, B.C. The mine has year-round road access, along with full access to grid power and diesel generators for backup. The site hosts gold mineral reserves (Dec. 2016) of 8.7M oz. Pretium plans an average gold production of 504,000 oz per year for the first eight years and 404,000 oz per year for the remaining mine life of 18 years. The Feasibility Study indicates a post-tax NPV at 5% of US$1.53 billion (at US$1,100/oz Au and US$14/oz Ag, February 2017) and a post-tax IRR of 28.5%. The mine began commercial operations in Q3/2017, and targets steady state production by mid-2018.

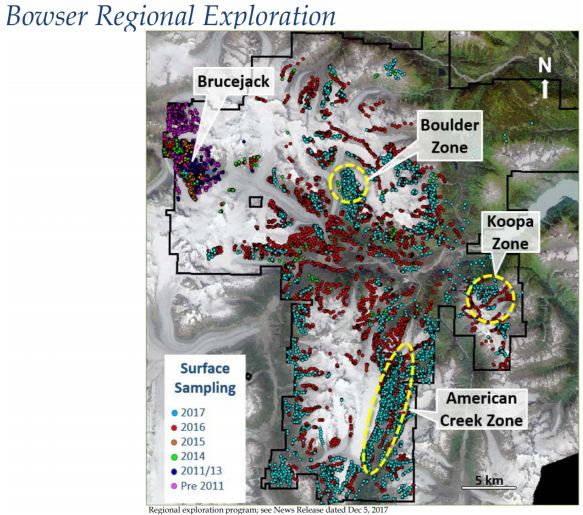

The Company is also exploring areas of unknown mineralization surrounding the Brucejack mine. A final data analysis is underway to refine high-priority targets for drilling in Spring 2018. As further review of the gathered data continues, the Company expects to identify additional high priority drilling targets. Figure 4 outlines current exploration activities.

Figure 4: Pretium Exploration

Source: Pretium Company Presentation

Source: Pretium Company PresentationOn June 18, 2018, Pretium announced that it had completed a portion of planned exploratory drilling at its Brucejack Mine and that it would be extending operations further East of the existing site. The Company’s stock climbed 3% over the following week.

Pretium is covered by 8 analysts. It has 6 Buy ratings and 2 Hold Ratings. Its average price target is $16.41, representing an upside of 70%.

Upcoming Catalysts:

Continued geopolitical instability could be a catalyst for rising gold prices. Fears of trade wars, tensions with North Korea and Russia, and continued Trump administration controversies could drive investors into non-U.S. assets.

Gold production, especially in Western countries, could increase soon. Australia, the world’s second-largest gold producer, is expected add up to 20t in new production throughout 2018, potentially reaching record levels of production. According to S&P, gold is responsible for ~75% of the increases in worldwide exploration expenditure in 2017, and global metals exploration is expected to rise by 20% in 2018.

To read our full disclosure, please click on the button below: