Nextleaf Solutions Ltd. (CSE:OILS), one of the pure-play cannabis extraction companies, announced that it has received a cannabis research license and was granted its 12th patent

SmallCapPower | January 23, 2020: Nextleaf Solutions Ltd. (CSE:OILS), one of the pure-play cannabis extraction companies, announced Thursday that its subsidiary, Nextleaf Labs, has received a Health Canada Research License and was awarded its 12th patent.

Research licence allows Nextleaf to conduct human trials. The license is Nextleaf’s second license following the Grant of the Standard Processing License on September 6, 2019. With the Research Licence, Nextleaf Labs is permitted to conduct R&D on analytical investigations of cannabis and its derivatives, the extraction, refinement, and purification of compounds from cannabis and hemp, and formulation of infused cannabis products, as well as human sensory trials.

Nextleaf receives its 12th patent. The Company also announced that it had received a standard patent by the Australian patent office for the filtration cell technology the Company uses in post-extraction processing of cannabinoids from cannabis and hemp. The filtration technology is significant because it allows for the removal of undesirable compounds from crude cannabis oil extracts in less time, achieving more efficient throughput rates, and a highly desirable, impurity-free, taste-less, smell-less, refined concentrate.

We continue to view that the macro set-up for Nextleaf as positive.

This is due primarily to two reasons:

1) ample biomass availability in Canada;

2) lack of capital available for cultivators to extract in-house.

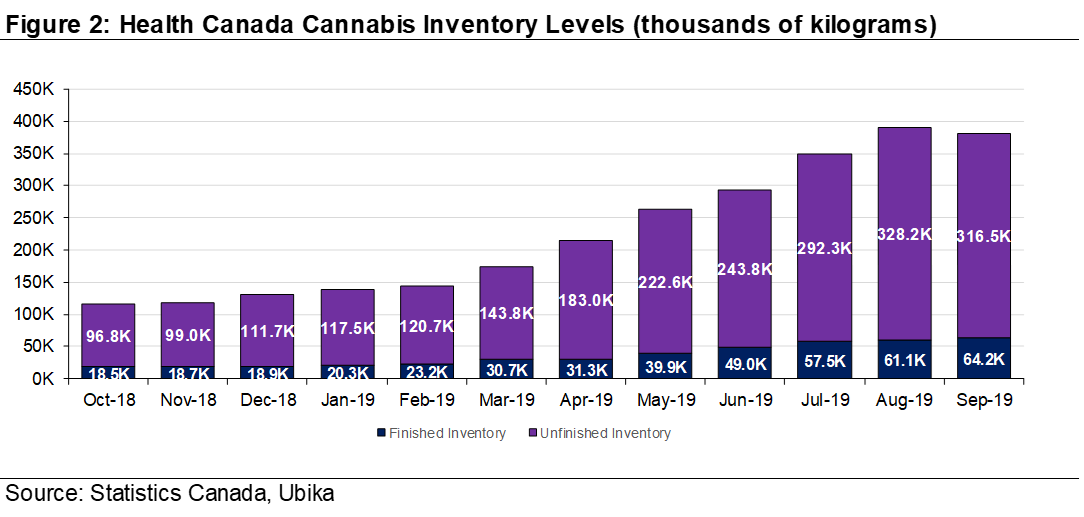

There are copious amounts of biomass available in Canada. We highlight two recent harvests: 1) on December 2, 2019, Aleafia announced it sold ~2,800 kg (of its 10,300 kg outdoor harvest) for $7.1M at $2.50/gram to an undisclosed producer, which may have been an extractor; 2) in November 2019, WeedMD completed an outdoor harvest of more than 20,000 clones on 27-acres, and anticipates a yield of more than eight tonnes of biomass (8,000 kg) at a cost of ~$0.16/gram. Overall inventory levels in Canada continue to grow quarter after quarter. To illustrate, in August 2019, inventory levels grew 11% to 390,000 kg of unfinished and finished biomass from ~350,000 kg in July 2019.

Lack of inferior Canadian processing capabilities, flawed “vertical integration” and a resulting slow Cannabis 2.0 rollout could create near-term industry setbacks. Recent quarterly announcements from large industry players, such as Aurora Cannabis and Canopy Growth, have suggested major cutbacks in capital projects. As an example, in conjunction with Aurora’s FQ1/20 results, the company reported two major capital cutbacks: 1) the ceasing of construction at its Nordic 2 facility in Denmark to save $80M over the next 12 months and; 2) the decision to “defer the majority of final construction and commissioning activities at its Aurora Sun facility for the foreseeable future” to save ~$110M in cash. We principally believe these cutbacks are due to poor financial forecasting and strategy. In our opinion, only a small number of licensed cultivators can fully process their own biomass at scale. As a result, due largely to the weakness of the cannabis market, lackluster strategy (such as focusing on C02 instead of ethanol-based processing) and shrinking budgets, we believe execution of Cannabis 2.0 from these large players will be mediocre at best. Though an industry setback overall, we believe these trends could be favourable for the third-party processors, which have ramped facilities that can process the biomass at scale. This supports our thesis that Nextleaf is likely close to securing its first major biomass tolling and/or white-labelling contract, presuming it can complete its equipment commissioning this month.

Recent weakness not justified. We believe Nextleaf’s share price weakness over the past few months was driven by a broader sector-wide selling correction. Companies with strong fundamentals were affected regardless of what segment of the cannabis market they were insulated in. We estimate that over the next few months, as retailers and consumers’ interest in Cannabis 2.0 spark up, and negative commentary falters, the whole space should benefit. In addition, companies focused on extraction, such as MediPharm Labs, Valens, and Nextleaf, will continue to report strong cash-flowing quarters, and fundamentals will begin to lead the way.

Shares of Nextleaf closed Wednesday’s trading session 5.3% lower at C$0.36. Nextleaf stock trades at a market cap of $38.8M.

Ubika Research/SmallCapPower has received compensation from Nextleaf Solutions Ltd. to provide analyst research coverage. For full disclosure please visit here >>

To read our full disclosure, please click on the button below: