Patrick Smith | Analyst | Ubika Research | Patrick@UbikaResearch.com | 1 (647) 444-5506

Alp Erdogan | Analyst | Ubika Research | Alp@UbikaResearch.com | 1 (647) 479-5690

William Xiao | Associate | Ubika Research | william.x@gicpartners.com | 1 (647) 828-4632

Oil price is starting to rise again as Iranian sanctions loom

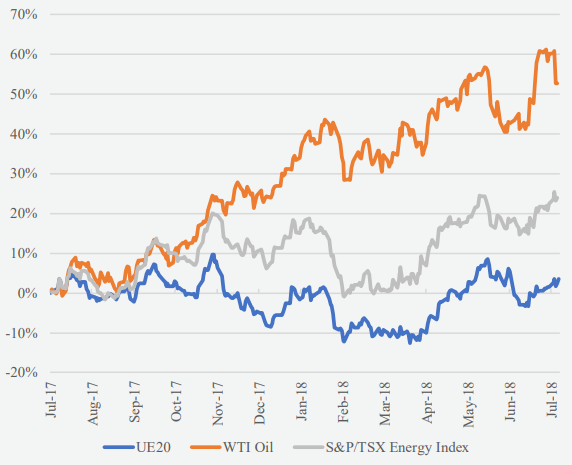

Ubika Energy 20 (May 24, 2018 - July 16, 2018)

UE20: -4.3% (3.6% Y/Y)

TSX Capped Energy: -2.3% (53.1% Y/Y)

Oil (WTI): 1.6% (25.2% Y/Y)

Dollar amounts in CAD unless otherwise stated

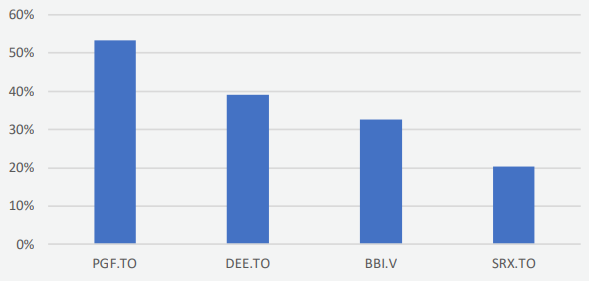

Top Volume Gainers (m/m)

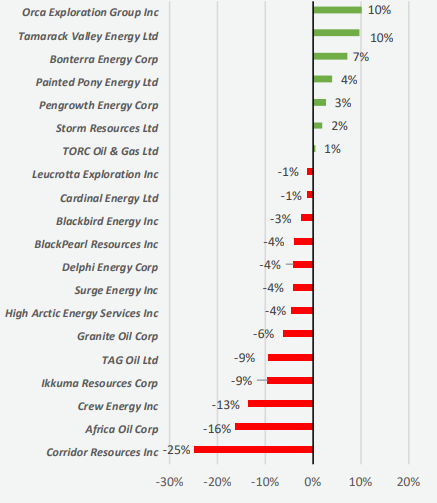

The Ubika Energy 20 Index declined 4.3% since our last report dated May 22, 2018, underperforming its benchmarks, WTI crude oil and the TSX/S&P Energy Index, which decreased 2.3% and increased 1.6%, respectively, over the same period. Notable performers for this report include:

- Corridor Resources Inc. (TSX:CDH), which slid 25% after poor exploration results at its Old Harry property.

- Orca Exploration Group Inc. (TSXV:ORC.B), which rose 10% following its Q1 earning report.

- Bonterra Energy Corp. (TSX:BNE), which gained 7% due to strong dividends with a 30% payout ratio.

Industry Highlights:

Canada’s federal government has agreed to purchase the Trans Mountain pipeline from Kinder Morgan (NYSE:KMI) for $4.5B. The Trudeau administration believes it can resolve regulatory issues and challenges from the provincial government in British Columbia. It plans to sell the project shortly after completion.

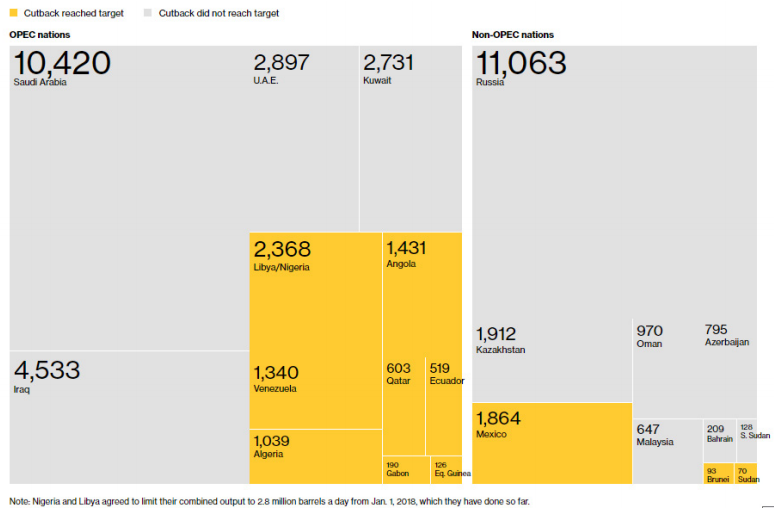

OPEC has agreed to increase production by up to 1M barrels/day. Compliance with cutbacks among non-OPEC members dropped as oil prices increased. Further adjustments are likely to be made as the price of oil continues to trade in a range. Below is a inforgraphic on compliance by country.

Figure 1: OPEC Cutback Complaince

Source: Bloomberg

Source: BloombergUE20 Performance Vs. Benchmarks

UE20: Performance Distribution

Upcoming Conferences:

- Summer NAPE- Houston, Texas, August 15-16, 2018. NAPE aims to bring together Oil & Gas industry participants, with hundreds of exhibitors and thousands of attendees.

Notable Performers

Crew Energy Inc. (TSX:CR)

Corridor is a natural gas-focused company operating in Eastern Canada. The Company’s stock price has dropped 25% since our last report date, due to poor exploration results at its Old Harry property.

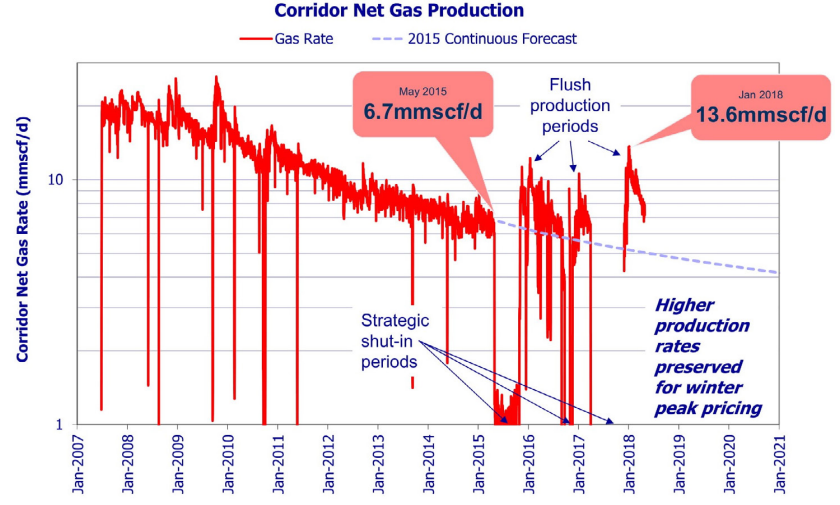

Corridor’s primary asset is the McCully Field, located 12km northeast of Sussex, New Brunswick. All 39 drills drilled at the site have intersected natural gas. Natural gas can be sold at dramatically higher prices during the winter, so the Company employs a “shut-in” strategy, in which it only produces during the winter season. Below is a graph of the McCully Field’s production since 2007.

Figure 2: Corridor Gas Production

Source: Crew Energy Inc. Corporate Presentation

Source: Crew Energy Inc. Corporate PresentationIn 2015, New Brunswick implemented a moratorium on hydraulic fracturing, which has since been extended indefinitely. The Company does not believe it can profitably drill additional wells without use of the technology, and so may not be able to leverage all of its reserves.

The Company also holds licenses for two other properties. The Frederick Brook Shale, also in New Brunswick, has had 13 wells drilled, including one well that was fracture-stimulated in 2008. Economical production cannot be conducted without the use of fracking. Old Harry is located 80km NW of Cape Anguille, Newfoundland and Labrador, and the Company holds licenses with both Quebec and Newfoundland and Labrador. The Company owns approximately 252,000 gross acres at the site and submitted a proposal for a single exploratory well in 2011.

On May 14, the Company released its Q1 2018 earnings report. Transportation expenses decreased to 18% of its prior-year expenses due to forward sale agreements. Operating cash flow increased 90% from the prior-year quarter, due to the doubling of natural gas sale prices.

On June 11, the Company announced the suspension of work on its Old Harry property. Geotechnical analysis indicated a more complex structure requiring further analysis, with more gas than oil, and so less total oil equivalent. Given these issues, the Company does not believe it can find a joint venture partner before the expiration of their license in 2021, and therefore has requested an extension from the governments. The Company’s stock price has declined 39% to-date.

Orca Exploration Group (TSXV:ORC.B)

Orca Exploration Group is a natural gas producer operating in Tanzania. The Company’s stock increased 6% since our last report date following its Q1 earnings release.

The Company’s flagship asset, the Discovery blocks in Tanzania, is located ~15 km off the coast and ~200 km south of Dar es Salaam. The blocks contain reserves of 405 Bcf.

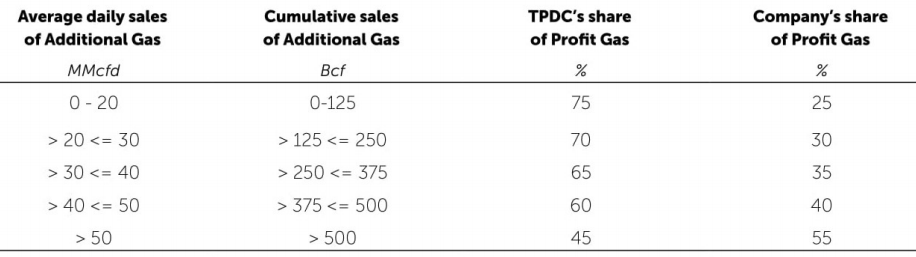

The Company has a 20-year agreement to sell gas to Songas Limited, the owner of the transportation infrastructure of the Discovery blocks. As part of the agreement, the Company operates the field and its related facilities on a “no gain no loss” basis. Orca sells a specified minimum, which for example was 13.7 Bcf in 2017, for Songas at no cost, and then can sell any extra gas. The more extra gas the Company produces, the higher share of the profit it takes, as shown below.

Figure 3: Orca Additional Gas Profits

Source: Company Annual Information Form

Source: Company Annual Information FormOn January 2, the Company announced it finalized terms for a US$130M investment by Swala Oil & Gas (Tanzania) plc (DSS:SWALA), a Tanzanian oil and gas company operating in Africa. Swala will buy 40% of PAE PanAfrican Energy Corporation (PAEM), a wholly-owned subsidiary of Orca, responsible for the Company’s Tanzanian operations. However, on January 22, the government told Swala to delay the purchase, and deadlines have been extended multiple times since.

On May 22, the Company released its Q1 2018 earnings report. The Company’s stock price added 10% over three days following its release.

On June 6, the Company responded to a Government of Tanzania Special Report. While the report has not been disclosed to the public eye management believes, based on a summary of it, that it contains several inaccuracies. The Company’s stock price eased 6% following the announcement.

The Company has a price target of $5.00. One analyst has a Buy rating.

Bonterra Energy Corp. (TSX:BNE)

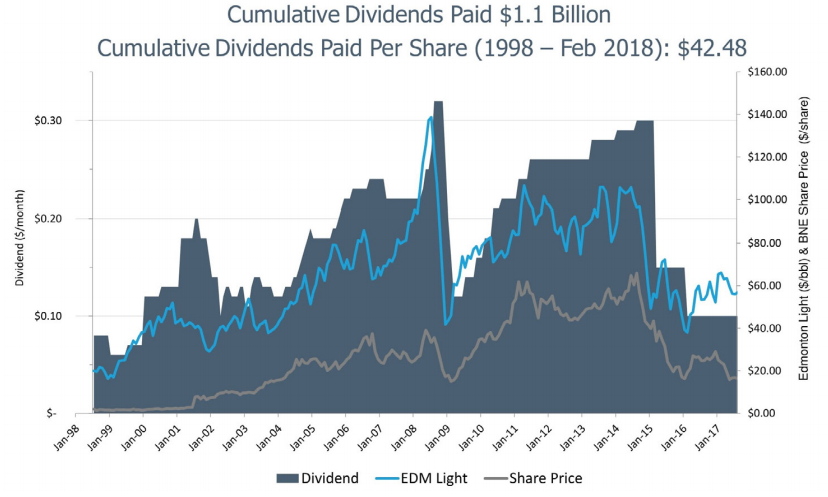

Bonterra Energy Corp. is a Canada-based energy company. The Company’s stock price has increased 6% since our last report, following continued releases of strong dividends.

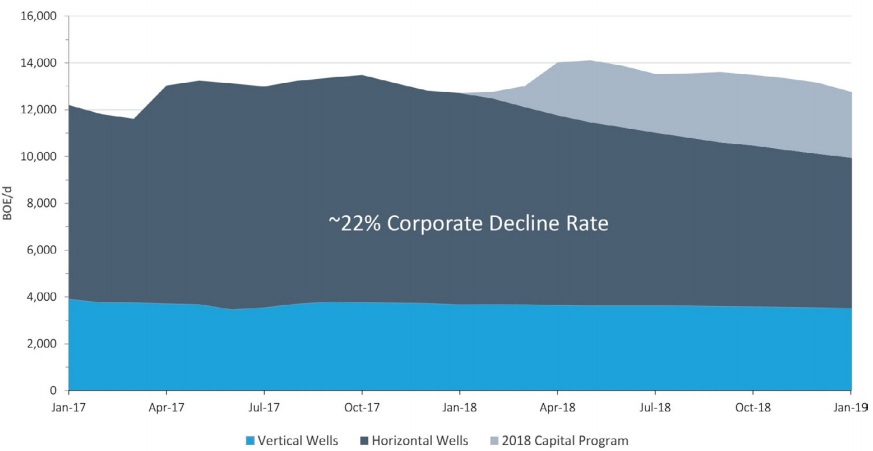

Bonterra operates in the Cardium field in Alberta, focused on light oil from the Pembina & Willesden Green Areas. Their assets consist of 353 gross sections (239 net), with 99.8M boe in P+P reserves (70% liquids). BNE operates 88.5% of its production with an average working interest of 76%. Production guidance is 13,400 boe/d for 2018, up from 12,825 at 61.6% liquids in 2017. Below is a graph of the Company’s expected production throughout 2017-2018.

Figure 4: Bonterra Production

Source: Company Presentation

Source: Company PresentationFigure 5: Bonterra Dividends vs. Share Price vs. Oil Price

Source: Company Presentation

Source: Company PresentationOn May 9, the Company released its Q1 2018 earnings report. Quarterly production increased 8% over the prior-year period, and the exit production rate was 14,600 boe/d. About 30% of the Company’s cash flow was paid as dividends. The Company’s share price declined 2% over the following week, and had decreased by 4% by the end of the month.

Between June 21 and the present, the Company’s stock price jumped 14%, following a US$5 increase in oil prices.

The Company has an average price target of $2.25, representing a 10% upside. The Company has 11 Buy ratings, 3 Hold ratings, and 2 Sell ratings.

Upcoming Catalysts:

As discussed in our previous report, the Trump administration is likely to place some degree of sanctions on Iran, and markets have reacted accordingly. Depending on the nature and severity of the action, prices could significantly shift following the announcement of such sanctions.

To read our full disclosure, please click on the button below: