Martello Technologies Group Inc. (TSXV:MTLO) stock has been on a roll ever since its Co-Chairman Bruce Linton was relieved of his duties at Canopy Growth Corporation (TSX:WEED)

SmallCapPower | July 12, 2019: Martello Technologies Group Inc. (TSXV:MTLO) is a technology company that provides control of complex IT infrastructures. The Company provides network appliances, software license services, and performance management solutions for real-time communications. Martello has cultivated relationships with key players in the industry and has a network of distributors and resellers doing business in more than 150 countries throughout the world.

In the past year, Martello Technologies has executed on two acquisitions and a public listing, which has helped contribute to its significant growth. Its growth has resulted in widespread recognition across the industry. In 2018, Martello received the Outstanding Information & Communications Technology Company Recognition Award from the Institute of Electrical and Electronics Engineers (IEEE), and a Frost & Sullivan Leadership Award for Network Performance Management. The Company also received two awards at the 2018 Best Ottawa Business awards: Best Ottawa Business and Deal of the Year for its RTO that took Martello Technologies public.

Product Overview

UC Performance Management

Unified Communications Performance Management helps clients to prevent, detect, and address performance issues on consolidated communication networks. These performance issues include delays, packet losses, and poor voice quality. Clients can detect and diagnose network quality issues using Matello’s advanced UC network testing process. Through this product segment, Martello’s also provides Mitel Performance Analytics (MPA), a 24/7 network performance monitor which alerts for detected problems.

SD-WAN and Enterprise Network Solutions

Martello’s SD-WAN and Enterprise Network Solutions help clients build a flexible and scalable network infrastructure at an affordable price. Martello Technologies boasts that its Enterprise Network Solutions feature enhanced performance and greater control relative to competitors.

IT Analytics and Visualization

Martello’s IT Analytics and Visualization product offering allows clients to integrate and control all their existing monitoring, cloud, and service management tools with sleek and modern personalized dashboards that can be accessed from any desired device.

Investment Thesis

Martello Technologies is poised to further benefit from Bruce Linton’s guidance as Co-Chairman as he uses his experience from his time at Canopy Growth Corporation as it former Co-CEO and Chairman. Bruce’s appearance on multiple TV interviews wearing a Martello T-shirt has propelled the Company stock price 216% higher over the past week, from $0.19 on July 2, 2019, to $0.60 on July 9, 2019. Bruce Linton is planning on helping the Company define and execute its strategy, which is focused on acquisition activity. Additionally, Martello’s management team already boasts extensive experience in the Internet Services & Infrastructure, Telecom Software, and Cyber Security industries.

Martello Technologies provides services for a diverse customer base across many industries. The Company currently works with customers in the hospitality, financial & banking, and education industry. This diversity has allowed Martello Technologies to be deployed in more than 5,000 networks and monitor over 16,000 devices. On May 31, 2019, the Company announced its demonstration of a network performance management solution that will be used for mobile applications, such as autonomous vehicles. Martello Technologies developed the proof of concept in collaboration with Blackberry QNX/L-Spark Accelerator. This development aligns with the growth of autonomous devices and places the Company in a favourable position to provide for that market.

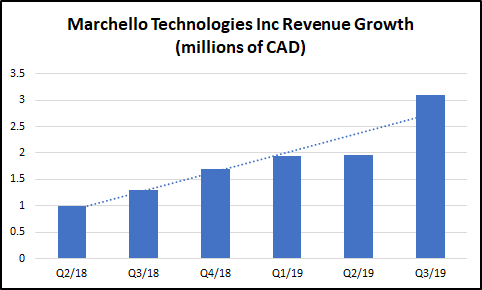

Martello is in a favourable financial position to continue to grow through its acquisition strategy. Martello has stated in its most recent MD&A that it intends to continue executing on its strategy of growth through acquisition activity. As of its most recent quarter, the Company has already realized rapid revenue growth, spurred by both organic growth and acquisition activity.

The Company currently has ~$6.7M in cash, with only $3.5M in debt. This cash on hand should help fuel its strategy to acquire companies with proven technology, stable financial positions, experienced management, and strong cross-selling channels.

Martello Technologies closed Thursday’s trading session up 17% at $0.75. Martello stock trades at a market capitalization of $143.4M.

To read our full disclosure, please click on the button below: