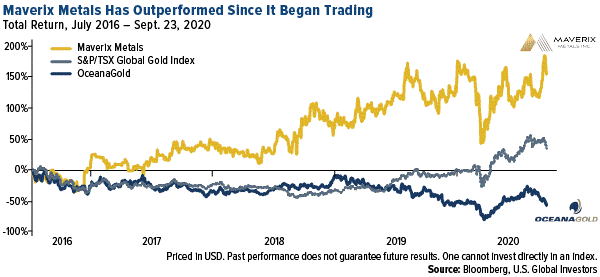

Since it began trading in July 2016, Maverix Metals Inc. (TSX:MMX) has outperformed the S&P/TSX Global Gold Index

Frank Holmes | October 5, 2020 | SmallCapPower: Another royalty and streaming company we have our eyes on is Maverix Metals Inc. (TSX:MMX), formed in 2016 after the company acquired a package of assets from Pan American Silver. Last week, Maverix entered into a binding purchase and sale agreement to buy a portfolio of 11 royalties from Newmont, including the Camino Rojo gold and silver project in Mexico.

(The following is an article originally published on usfunds.com on September 28, 2020)

The transaction, according to a note by Raymond James, “provides Maverix with potential near-term gold equivalent ounce (GEO) and cash flow growth from five development assets in the Americas, while adding longer-term optionality through the six exploration properties.”

Raymond James has given the stock an Outperform rating, with a price target of C$7.50.

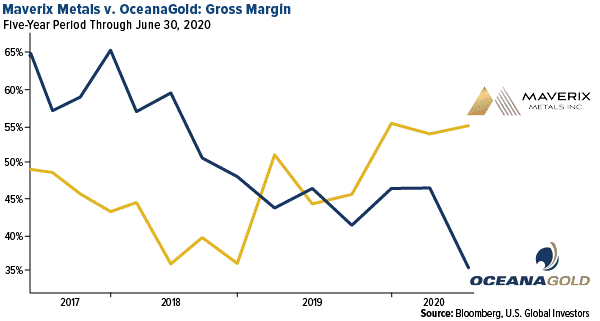

We like the stock and, based on our quantamental stock-picking model, have recently added it our portfolio. This replaced Australia-based producer OceanaGold. Maverix’ gross margin overtook OceanaGold’s in 2019 and has only continued to increase, which is why we made the rotation.

Since it began trading in July 2016, Maverix has outperformed OceanaGold and other global gold stocks.

Randy Smallwood: Precious Metals in “Golden Times”

Gold and silver are in “golden times” right now, according to Wheaton Precious Metals’ president and CEO Randy Smallwood during an online Denver Gold event last week. The “helicopter money” from governments will continue to be highly supported of prices.

Randy is also optimistic on base metals, saying they are likely to be the bulk of streaming deal opportunities going forward. “It’s good to see money going to the ground in the base-metals space,” he commented.

Wheaton Precious is planning to list on the London Stock Exchange by year end, which will put the $23 billion streaming company on the radar of United Kingdom investors who are seeking to gain equity exposure to precious metals. Wheaton currently trades in Toronto and New York.

I believe this is a well-timed decision on the part of Randy, who was named the new chair of the World Gold Council (WGC) earlier this month. According to Edison Investment Research, precious metal companies listed in London “have tended to outperform their peers, with 52 percent of London-listed companies outperforming the gold price over the period of the worst depredations of the coronavirus so far this year, compared with 39 percent globally.”

Further, Wheaton Precious “will provide premium-quality, geared exposure to precious metals prices and fill a void for investors left by the departure of Randgold Resources in December 2018 after it was acquired by Barrick,” analyst Charles Gibson wrote in a note dated September 22.

As you know, Wheaton is one of our favorite mining stocks. At present it pays out 30 percent of its cash flow in dividends, but this could rise to between 40 percent and 50 percent with higher metal prices, Randy says.

To read our full disclosure, please click on the button below: