Patrick Smith | Analyst | Ubika Research | Patrick@UbikaResearch.com | 1 (647) 444-5506

Alexander Cardno | Associate | Ubika Research | Alexander@UbikaResearch.com | 1 (519) 781-2426

Sumair Abid | Associate | Ubika Research | Sumair@UbikaResearch.com | 1 (647) 447-5856

British Columbia’s prolific Golden Triangle district has produced some big winners in the junior resource stock space

Golden Triangle 20 (June 1, 2018— September 21, 2018)

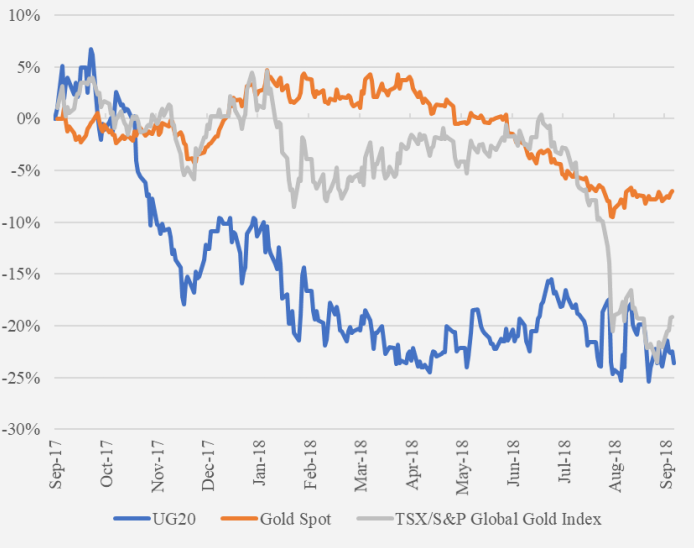

GT-20: -3.7% (-23.6% Y/Y)

Gold Price: -7.2% (-7.5% Y/Y)

TSX Gold Index: -17.4% (-20.0% Y/Y)

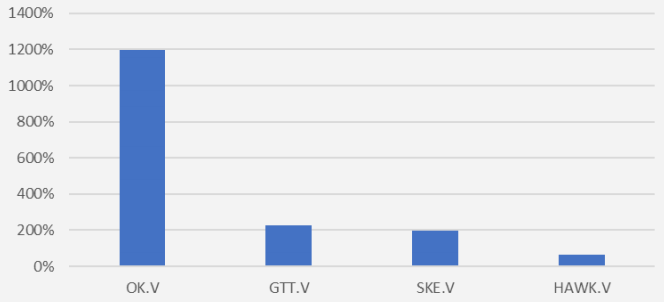

Top Volume Gainers (m/m)

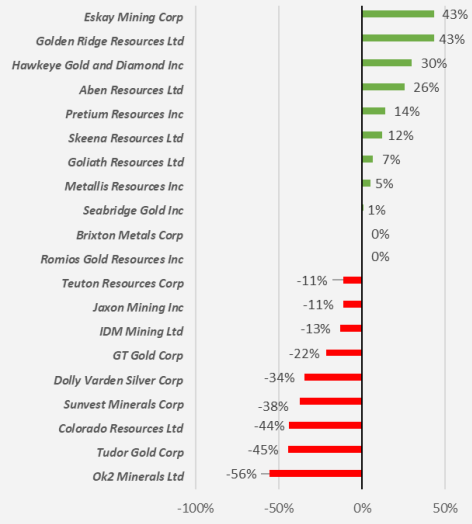

In this special report we examined 20 gold exploration/development companies from British Columbia’s prolific Golden Triangle district and highlighted our favourites. While most explorers/developers have largely disappointed this year, there has been a select group of Golden Triangle juniors that have been shining. Each company is one drill hole away from a significant shift in value. To illustrate, our selected 20 Golden Triangle companies have significantly outperformed the Vectors Junior Gold Miners Index (GDXJ) and the TSXV, which declined 16% and 6% over the same period, respectively. Our selected performers in the group were:

- Golden Ridge Resources Ltd. (TSXV:GLDN), which increased 47% since June 1, 2018, after releasing drilling results from the Williams Zone property located on the Company’s Hank Project.

- GT Gold Corp. (TSXV:GTT), which saw its shares slid 22% since June 1, 2018, despite recently-announced assay results strongly suggesting a significant Au-Cu-Ag porphyry discovery at the Saddle North target on its Tatogga property.

- Aben Resources Ltd. (TSXV:ABN), which saw its stock climb 25% since June 1, 2018, after discovering high-grade zones of gold at its Forrest Kerr Property.

- Goliath Resources Ltd. (TSXV:GOT), which saw its share price jump 7% since June 1, 2018, after the discovery of what the Company called several new significant zones of widespread mineralization at surface at its Lucky Strike property.

Industry Highlights:

- Gold prices continue to fall. The spot price of gold has declined 3.1% quarter to date. Year to date, prices have fallen 7.5% .

- Rising Rates and Emerging Market Currency Crisis: Rising interest rates and a continued meltdown in emerging market currencies could further spook investors, resulting in a rush to safe-haven assets such as the U.S. dollar and, thus, putting downward pressure on gold prices.

GT-20: Performance vs. Benchmarks Y/Y

Top Volume Gainers (m/m)

Upcoming Events:

The Silver & Gold Summit; Cambridge House International. Hilton San Francisco Union Square Hotel, San Francisco, October 28 – 29th, 2018.

Notable Performers

Golden Ridge Resources Ltd. (TSXV:GLDN)

Golden Ridge Resources is focused on high-grade gold and silver in the Golden Triangle district of British Columbia. The Company’s shares have generated a return of 47% since June 1, 2018, including a 20% gain following the August 27, 2018 announcement of favourable survey results from the William’s Zone, located within the Hank Project. Golden Ridge is currently drilling a 6,000m program at the Hank project and is cashed up for the near-term with $2M in the bank. Importantly, the team is led by “legendary” explorer Larry Nagy, who was instrumental in the discovery of the SNIP mine for Delaware Resources, which eventually moved from $1/share to $28/share on a takeover. As well, Mr. Nagy was behind the discovery by Stikine Resources and the Eskay Creek property, which turned out to be Canada’s highest grade gold mine. Stinkine’s stock moved from $1/share to $67/share at takeover.

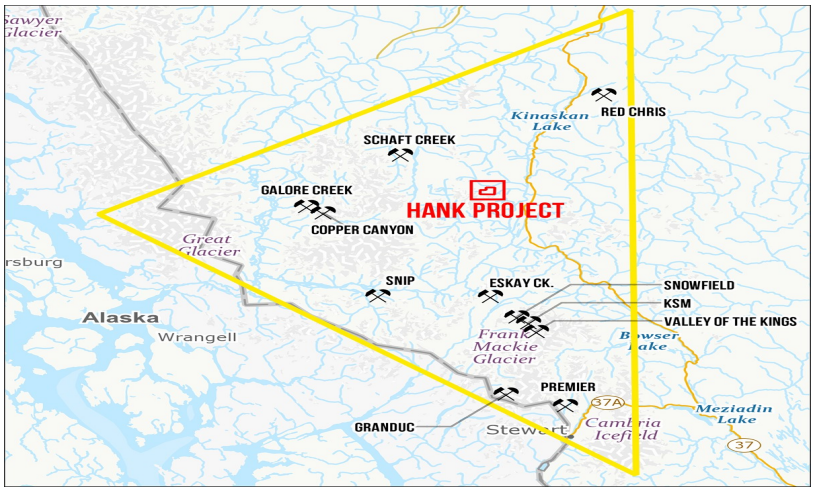

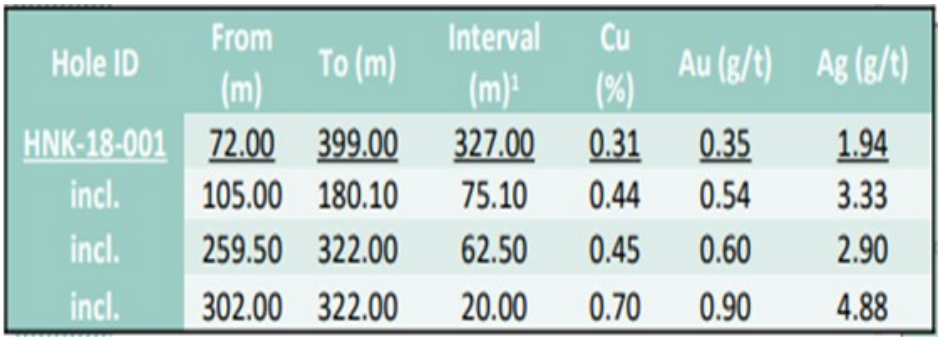

The Company announced recently the discovery of an alkalic porphyry system in the William’s Zone following the release of drill results for the William’s Zone Discovery Hole HNK-18-001. In the three days following the announcement, its stock price increased by 20%. HNK-18-001 includes grading of 0.44% Cu, 0.54 g/t Au, and 3.3 g/t Ag over 75 meters. Figure 1 below depicts the location of the Hank Project within the Golden Triangle, while Figure 2 illustrates the grading at various intervals for HNK-18-001.

Figure 1: Location of Hank Project within Golden Triangle.

Source: Company Website

Source: Company WebsiteFigure 2: Grading of discovery hole HNK-18-001.

Source: Company Presentation

Source: Company PresentationGT Gold Corp (TSXV:GTT)

GT Gold is a Golden Triangle explorer that had two major discoveries in 2017 at its flagship Tatogga property. Its first discovery at Saddle South won the Exploration Discovery Awards at the UK’s mines & Money show in November 2017. The second discovery and Saddle North greatly improved the potential size of the project. Since June 1, 2018, the Company’s stock price fell by up to 51% before rebounding 74% after announcing that it had drilled high-grade intervals as part of the Saddle South discovery. Its stock then eased 5% following a round of equity financing ranging between $0.67 and $0.77 a share. While the stock has come off from its initial discoveries, it still has significant exploration upside.

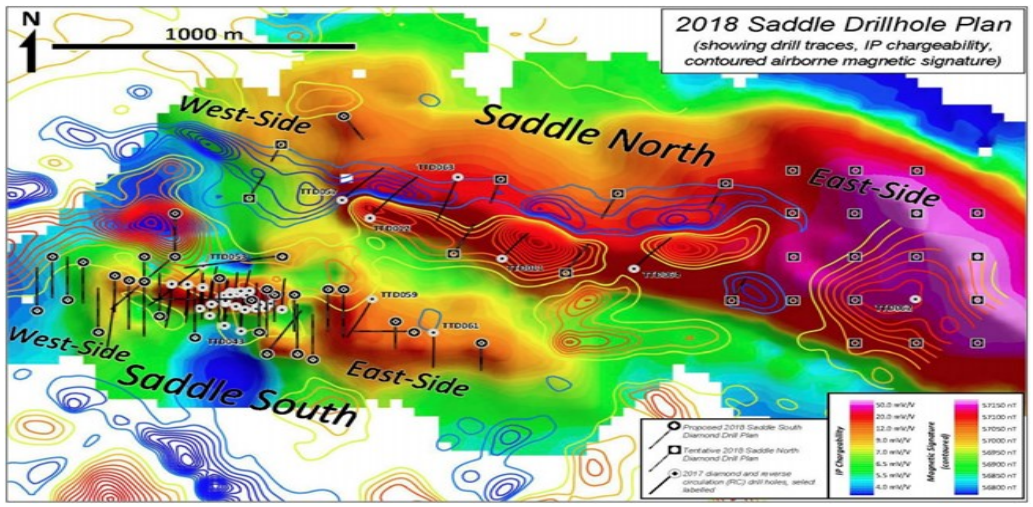

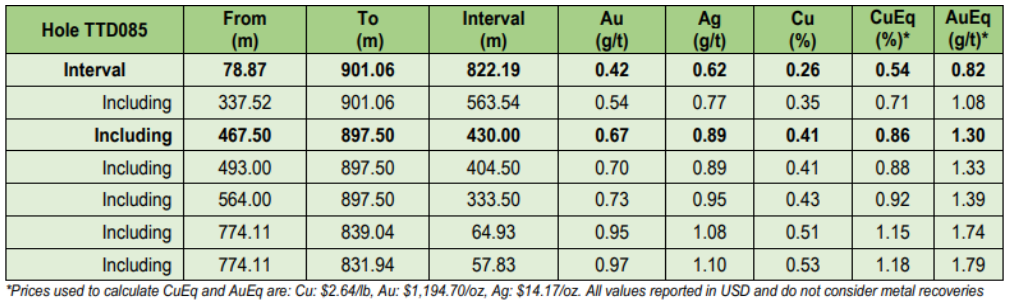

The flagship Tatogga property contains the Saddle North and Saddle South gold discoveries, with magnetic anomalies estimated to cover 2.4km and 1.5km, respectively. Figure 3 provides several drill locations within the Saddle area. Saddle South has yielded several high-grade intercepts, including results as rich as 51.53 g/t Au over 6.95 meters. More than 16,000 meters have been drilled in 86 holes at Saddle South. On September 10, 2018, the Company announced assay results from the Saddle North region, providing evidence of a large porphyry Au-Cu-Ag discovery. Drill results of note included 0.67 g/t Au, 0.89 g/t Ag, and 0.41% Cu over 430 metres. The complete drill results are included below, in Figure 4. The stock closed 44% higher following the announcement.

Figure 3: The Saddle area, divided into Saddle North and Saddle South

Source: Company Presentation

Source: Company PresentationFigure 4: Hole TTD085 Assay Results

Source: Company Presentation

Source: Company PresentationAben Resources Ltd. (TSXV:ABN)

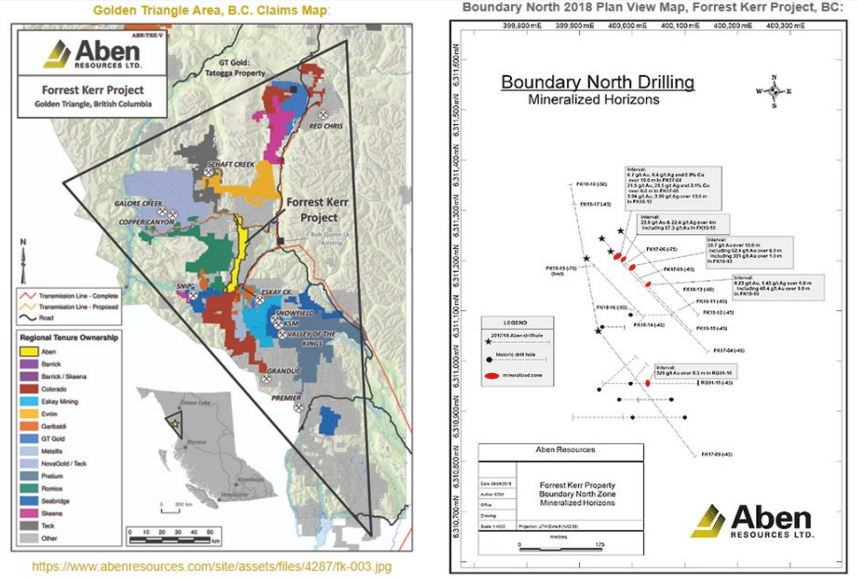

Aben Resources is a gold exploration company with projects located in British Columbia’s Golden Triangle district as well as in Saskatchewan and the Yukon. The Company’s stock price has surged 25% since June 1, 2018, due primarily to positive assay results for the Forrest Kerr Gold Project and the Southern Boundary mineralized zone discovery.

The Company’s 100%-owned flagship property, the Forrest Kerr Gold Project, is 23,000 hectares and located in northwestern British Columbia. On August 9, 2018, Aben announced that its first drill hole of 2018 yielded multiple high-grade zones, with the highest-grade zone consisting of 331 g/t Au over 1 meter within a broad zone averaging 38.7 g/t gold over 10.0 metres. By the end of August 2018, the Company had completed 4,850 meters of drilling at 16 locations. Most drilling sites were concentrated in high-priority areas of the Northern Boundary (first assayed in 2017) but a 1,150m drilling campaign was completed at the southeast side of the property, referred to as the Southern Boundary target.

Recently, 2018 exploration results at the Northern Boundary at Forrest Kerr indicated high-grade zones, including 62.4 g/t Au over 6 meters, causing Aben’s stock price to soar 111% over a fourday period. Follow-up drilling at Forrest Kerr is expected to continue into the fall. Figures 5 and 6 below depict the Forrest Kerr Project in relation to other mining operations within the Golden Triangle. As of March 31, 2018, the Company held more than C$15.5M in cash.

Figures 5 (Left) and 6 (Right): Location of the Forrest Kerr Project

Source: Company Presentation

Source: Company PresentationIn Saskatchewan, Aben Resources owns an 80% interest in the Chico gold project. In 2018, the Company had plans for an extensive 10,000-meter winter drilling program that was ultimately suspended following a request by the citizens of Pelican Narrows, SK and members of the Peter Ballantyne Cree Nation (PBCN).

Goliath Resources Ltd. (TSXV:GOT, Frankfurt:B4IE)

Goliath Resources is a project generator and exploration company focused on four projects within the Golden Triangle and surrounding area. All four projects have significant upside potential that could host new elephant-size discoveries that would tick the boxes for any senior mining company. Its stock price has increased 7% since June 1, 2018, following consistent news releases about drilling progress at both the Copperhead and Lucky Strike properties.

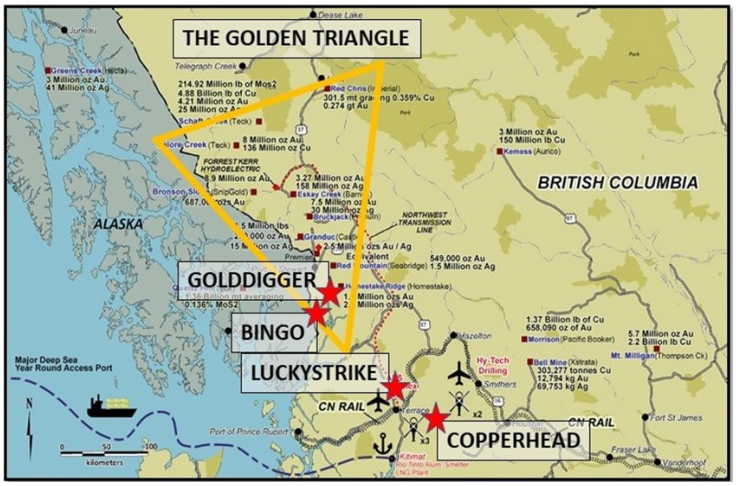

The Company controls four properties that include Bingo, Copperhead, Golddigger and Lucky Strike covering 44,003 hectares. Two of the properties, Bingo and Golddigger, are located within BC’s Golden Triangle while Copperhead and Lucky Strike are just south of the Golden Triangle located within the Skeena Arch of British Columbia close to existing power lines and major infrastructure. Goliath’s flagship project is the Lucky Strike project, 40 km north of Terrance BC and covers 24,951 hectares. It has a massive textbook geophysical and geochemical porphyry drill target for 2018 that covers 2500 x 1500 x 500 metres at its Prosperity Zone. In addition, a new area named the Gold Source Zone has been discovered where a 2017 hydrothermal breccia sample assayed 96.8 g/t gold (3.1 ounces per ton); the new zone is an epithermal, milky quartz hydrothermal breccia and sheeted vein corridors extend more than 400 metres along an E-W trend and over 200 metres wide and remains open. As seen below, Figure 7 depicts the four exploration projects of Goliath Resources in relation to the Golden Triangle.

The Company’s Copperhead property covers 4,354 hectares and is located 35km southwest of Smithers B.C. The area is dominated by Massive Sulphide breccias that have yielded copper mineralization of up to 7.97% and silver 45.41 g/t. This property is being drilled during its 2018 program. Goliath owns a 10% interest in the DSM syndicate, a project generator focused on discovering areas of glacial and snowpack recession.

Figure 7: Location of Goliath’s four mining assets

Source: Company Presentation

Source: Company PresentationUpcoming Catalysts:

- Worsening Trade Conditions: A failure to reach a trade understanding between the U.S. and China could result in a flight to safe-haven assets such as the U.S. dollar, further straining gold prices, which are already 12% below their peak of US$1365 in April. Meanwhile, continued trade tensions with Canada could continue to depress the Canadian dollar, widening margins for producers who primarily generate revenues in U.S. dollars.

- A Brexit deal “realistic in 6 – 8 weeks”: EU Negotiator. A Brexit deal could prop up the Euro and Pound, making gold cheaper for buyers in the U.K. and Europe, pushing up the price of gold.

To find out more about Goliath Resources Limited (TSXV:GOT), please visit the company’s Investor Hub.

Ubika Research/SmallCapPower has received compensation from Goliath Resources Limited. to provide analyst research coverage. For full disclosure please visit here >>

To read our full disclosure, please click on the button below: