The TSX stocks on our list have anticipated Y/Y EPS growth as high as 550%

SmallCapPower | March 28, 2017: Canada Goose Holdings Inc.’s (TSE:GOOS) IPO has garnered a lot of attention from investors, and rightfully so, with Y/Y EPS growth of over 83%. However, fashion has a cycle, such as platform shoes and bell-bottoms, and this type of earnings growth is likely unsustainable. Today we have identified five TSX stocks that are expected to have greater 2017 earnings per share (EPS) growth than Canada Goose, year-over year.

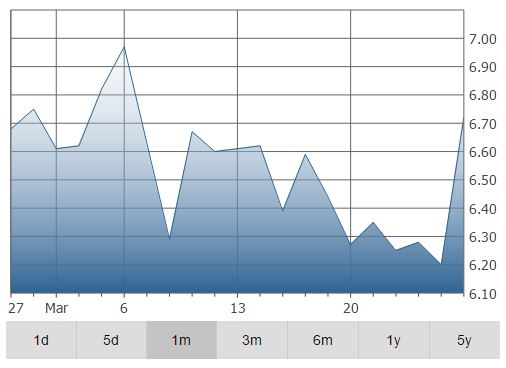

Aphria Inc. (TSX: APH) – $6.20

Aphria Inc. (TSX: APH) – $6.20

Pharmaceuticals

Aphria Inc., formerly Black Sparrow Capital Corp., is a Canada-based company, which is engaged in producing and selling medical marijuana through retail sales and wholesale channels. The Company’s retail sales are sold primarily through the Company’s online store, as well as telephone orders. Its wholesale shipments are sold to other Medical Purposes Regulations (MMPR) Licensed Producers. It offers medical cannabis of various strains, including Kusawa, Tamaracouta, Panache, Churchill and Iroquois. The Company is also engaged in the research and development, and commercial production of cannabis oil.

- Market Cap: $772.9 million

- Revenue (FY0): $8.4 million

- Total Debt to Total Equity, Percent (FY0): 0.0%

- Expected EPS Growth (FY1/FY0): 133%

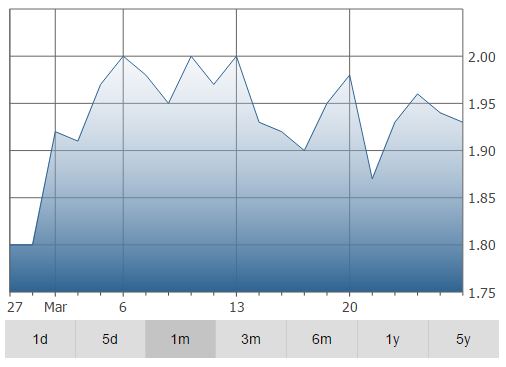

5N Plus Inc. (TSX: VNP) – $1.94

5N Plus Inc. (TSX: VNP) – $1.94

Specialty Mining & Metals

5N Plus Inc (5N Plus) is a Canada-based producer of specialty metal and chemical products used in a number of pharmaceutical, electronic and industrial applications. The Company operates in two business segments: Electronic Materials and Eco-Friendly Materials. The Electronic Materials segment manufactures and sells refined metals, compounds and alloys, which are used primarily in a range of electronic applications. Its Electronic Materials segment’s products are associated with various metals, such as cadmium, gallium, germanium, indium and tellurium. The Eco-Friendly Materials segment manufactures and sells refined bismuth and bismuth chemicals, low melting-point alloys, as well as refined selenium and selenium chemicals.

- Market Cap: $162.5 million

- Revenue (FY0): $310.9 million

- Total Debt to Total Equity, Percent (FY0): $49.1%

- Expected EPS Growth (FY1/FY0): 382%

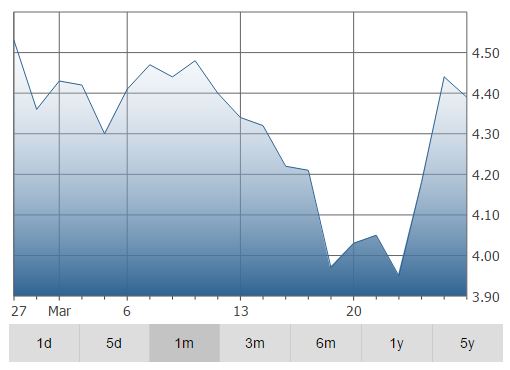

Pure Technologies Ltd. (TSX: PUR) – $4.44

Pure Technologies Ltd. (TSX: PUR) – $4.44

Industrial Machinery & Equipment

Pure Technologies Ltd. (Pure) is engaged in the development and application of technologies for inspection, monitoring and management of physical infrastructure, including water and hydrocarbon pipelines, buildings and bridges. The Company’s segments include Americas, International and PureHM. Its technologies include SoundPrint acoustic monitoring technology, which is used to provide continuous remote health monitoring of water and wastewater pipelines, bridges, buildings, parking structures and other infrastructure components.

- Market Cap: $242.9 million

- Revenue (FY0): $115.0 million

- Total Debt to Total Equity, Percent (FY0): 0.0%

- Expected EPS Growth (FY1/FY0): 550%

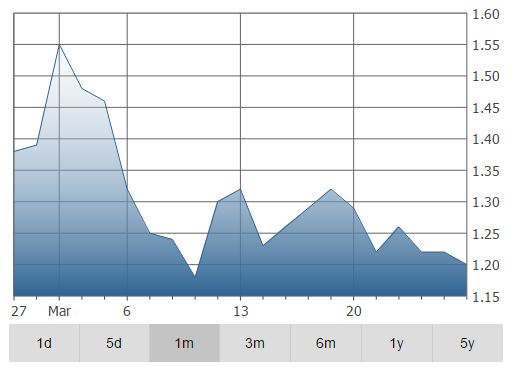

Trevali Mining Corp. (TSX: TV) – $1.22

Trevali Mining Corp. (TSX: TV) – $1.22

Diversified Mining

Trevali Mining Corporation is a Canada-based natural resource company engaged in the acquisition, exploration, development and production from mineral properties. The Company holds approximately four properties in Canada and has an interest in a property in Peru with an option on a second Peruvian property. The Company, through its subsidiary Trevali Peru S.A.C., operates the Santander underground metallurgical plant and mine located in Peru. It is producing zinc and lead-silver concentrates. In Canada, the Company owns through its subsidiaries, the Caribou mine and mill, the Halfmile mine and the Stratmat polymetallic deposit all located in northern New Brunswick.

- Market Cap: $492.1 million

- Revenue (FY0, Default): $198.2 million

- Total Debt to Total Equity, Percent (FY0): 31.1%

- Expected EPS Growth (FY1/FY0): 343%

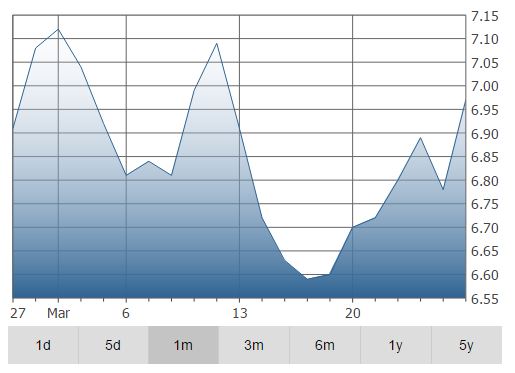

DIRTT Environmental Solutions Ltd. (TSX: DRT) – $6.78

DIRTT Environmental Solutions Ltd. (TSX: DRT) – $6.78

Business Support Services

DIRTT Environmental Solutions Ltd. is a manufacturer of customized interiors. The Company combines its three-dimensional (3D) design, configuration and manufacturing software (ICE or ICE Software) with in-house manufacturing of its prefabricated interior construction solutions and a distribution partner (DP) network. The Company operates in Canada and the United States. ICE provides design, drawing, specification, pricing and manufacturing process information.

- Market Cap: $575.5 million

- Revenue (FY0): $267.0 million

- Total Debt to Total Equity, Percent (FY0): 10.3%

- Expected EPS Growth (FY1/FY0): 167%