According to an analysis of CME futures contract, large institutional investors could be shifting away from Bitcoin in favor of gold

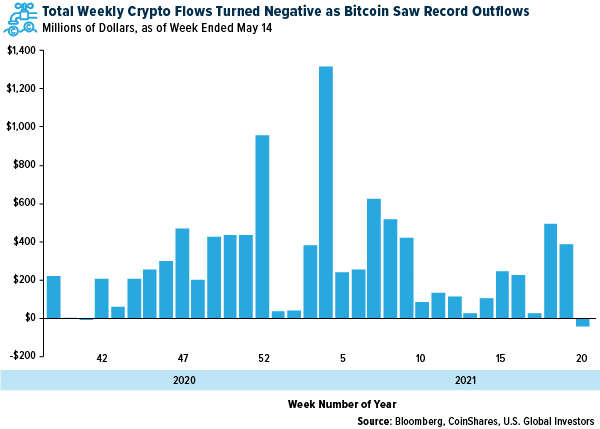

Frank Holmes | May 26, 2021 | SmallCapPower: Investors yanked $98 million out of Bitcoin investment products in the week before last, the most on record, after Tesla chief Elon Musk announced in a tweet that he was suspending vehicle purchases using the cryptocurrency. This amount was enough to offset net inflows of $48 million into all other digital asset funds. Ether funds, for instance, attracted $27 million, bringing the crypto’s weekly trading volume to an incredible $4.1 billion, the most ever, according to CoinShares.

(The following is an article originally published on usfunds.com on May 24, 2021)

Bitcoin came under pressure from more than just Musk’s distorted comments on its energy usage. The Chinese government has also cracked down on the crypto ecosystem, banning financial institutions from providing services related to digital assets. A hotline has even been set up in one Chinese province that people can use to snitch on neighbors they suspect of mining cryptos.

Of course, this is only the 10,000th time China has come out against crypto. More FUD.

Last week’s selloff was dramatic. By Wednesday, Bitcoin was down more than 40% from its all-time high of $64,000, set in mid-April. The token’s market dominance fell to a three-year low of 40%.

I believe the pullback is healthy. It’s important for investors to remember that this kind of volatility is normal for such a still-emerging, speculative asset class. It’s also important to keep things in perspective: Bitcoin is still up more than 30% so far this year, 315% for the 12-month period.

Institutional Investors Rediscovering Gold

So where have all the millions that have flowed out of crypto funds gone to? Would you be surprised to hear gold?

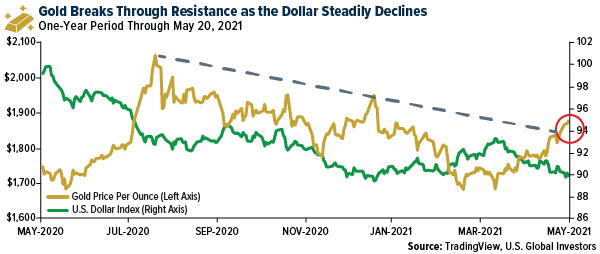

According to an analysis of CME futures contract, large institutional investors could be shifting away from Bitcoin in favor of gold. “Over the past month, Bitcoin futures markets experienced their steepest and more sustained liquidation since the Bitcoin ascent started last October,” JPMorgan wrote in a recent note to investors. These liquidations have corresponded with inflows into gold ETFs.

The price of the yellow metal broke through key resistance last week, touching $1,890 an ounce for the first time since January on a declining U.S. dollar. The next test is $1,900, and after that, its all-time high of $2,067.

Whereas Bitcoin is a speculative asset, gold is a well-established, highly liquid asset with a centuries-long track record. We know what the price drivers are.

Besides responding to a weaker dollar, gold is finding traction from ongoing unprecedented money-printing and monetary stimulus. The amount of M2 money circulating the U.S. economy is up about 21% from a year ago. Meanwhile, the Federal Reserve maintains its bond-buying program. As of last week, the size of the central bank’s balance sheet was just under a staggering $8 trillion.

To read our full disclosure, please click on the button below: