The Canadian dividend stocks we’ve uncovered have yields over 4% and low payout ratios

SmallCapPower | June 15, 2022: During periods of elevated stock-market uncertainty, risk is mitigated through low volatility stocks with steady dividends. Today we have discovered three Canadian dividend stocks with yields over 4% and low payout ratios, which could mean a dividend hike in the future.

*Share price data and other metrics as of June 10, 2022

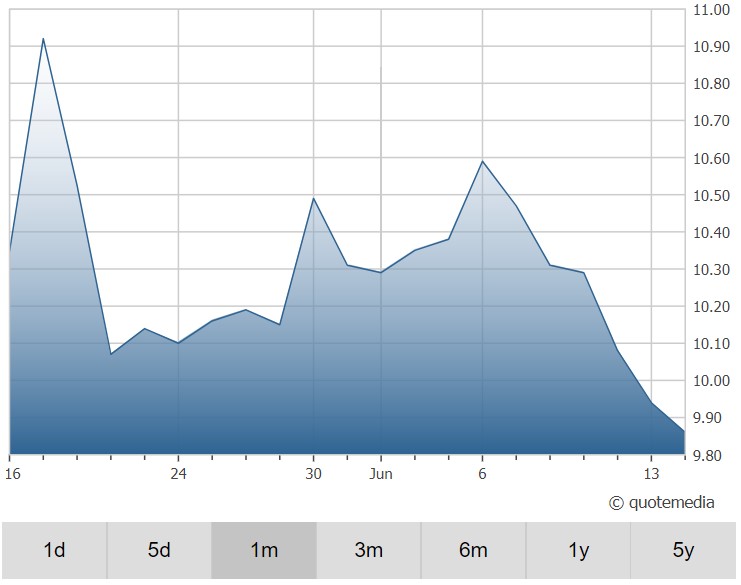

Cascades Inc. (TSX:CAS) – $10.29

Cascades Inc. (TSX:CAS) – $10.29

Paper Products

Cascades, along with its subsidiaries, produces, converts and markets packaging and tissue products composed mainly of recycled fibres. The Company is organized into four main business segments: Containerboard, Boxboard Europe, Specialty Products (which constitutes packaging products), and Tissue Papers. The business activity of the company functions in Canada, the United States, Italy, and other countries. Its customer base includes food processing companies, the maintenance industry, accommodations, and housing industry, micro-businesses, and boutiques.

- Market Cap: $1,023.1M

- 7-Day Return: -2.9%

- 30-Day Return -3.7%

- 30-Day Average Trading Volume: 336,246

- Dividend Payout Ratio: 39.1%

- Dividend Yield: 4.7%

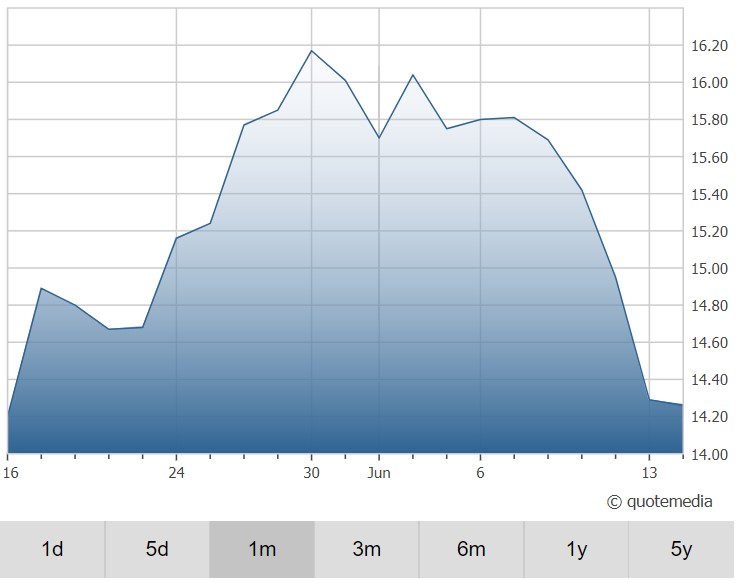

![]() CI Financial Corp. (TSX:CIX) – $15.42

CI Financial Corp. (TSX:CIX) – $15.42

Financial Services

CI Financial is a diversified provider of wealth management products and services, primarily in the Canadian market. The Company had C$129.2 billion in fund assets under management, and another C$221.5 billion in assets under advisement, at the end of April 2022, making it one of the largest nonbank affiliated asset managers in Canada. CI Financial operates primarily through CI Global Asset Management, which offers a broad selection of investment funds. On the wealth management side, the Company operates through CI Assante Wealth Management, Aligned Capital Partners, CI Private Wealth, as well as a growing group of acquired U.S.-based advisors, providing financial advice primarily to high-net-worth individuals and families.

- Market Cap: $2,9463M

- 7-Day Return: -5.1%

- 30-Day Return: +5.3%

- 30-Day Average Trading Volume: 739,952

- Dividend Payout Ratio: 23.2%

- Dividend Yield: 4.9%

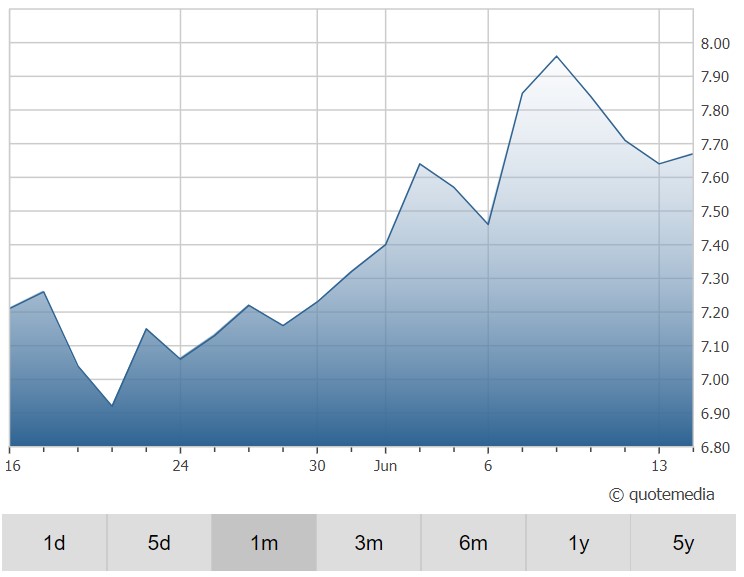

![]() DRI Healthcare Trust (TSX:DHT.UN) – $7.84

DRI Healthcare Trust (TSX:DHT.UN) – $7.84

Healthcare

DRI Healthcare Trust is an open-ended trust that provides unitholders with differentiated exposure to the anticipated growth in the global pharmaceuticals and biotechnology markets. Its business model is focused on managing and growing a diversified portfolio of pharmaceutical royalties to deliver attractive growth in cash royalty receipts over the long term. Geographically, it has a presence in the United States; European Union; Japan, and rest of the world.

- Market Cap: $299M

- 7-Day Return: +1.8%

- 30-Day Return: +6.9%

- 30-Day Average Trading Volume: 31,377

- Dividend Payout Ratio: 14.6%

- Dividend Yield: 5.4%

To read our full disclosure, please click on the button below: