Just before earnings season the majority of analysts expect the stocks on our list to rise

SmallCapPower | September 7, 2016: Earnings season is just around the corner for the stocks on our list today. For these companies, analysts are expecting earnings to improve, hence the high target price estimates. With financial results releases being the most scrutinized time in a company’s life cycle, we wonder if the share price movements will follow suit with what analysts are forecasting.

DHX Media Ltd. (TSE:DHX.B) – $7.69

DHX Media Ltd. (TSE:DHX.B) – $7.69

Entertainment Production

DHX Media Ltd. is a Canada-based children’s entertainment company. The Company’s business is producing, distributing, broadcasting and exploiting the rights for television and film programming, primarily focusing on children, youth and family productions. It has five integrated business lines: production; library and distribution (including digital distribution) of its third party acquired titles; television broadcasting; merchandising and licensing, and new media and interactive. Its productions include Degrassi franchise, Supernoobs, Slugterra 3, Teletubbies, This Hour Has 22 Minutes, and Make It Pop.

- Market Cap: $1,026

- Expected Report Date: 9/25/2016

- Implied Upside: 35%

- Price Target – Mean: $10.36

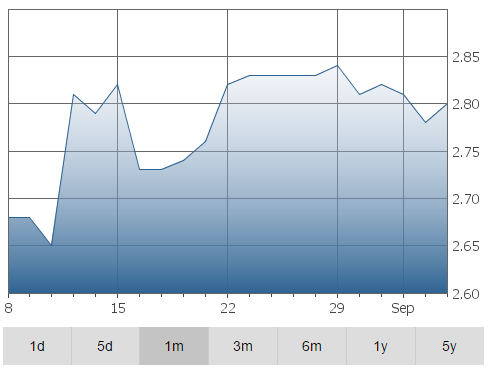

Theratechnologies Inc. (TSE:TH) – $2.56

Theratechnologies Inc. (TSE:TH) – $2.56

Pharmaceuticals

Theratechnologies Inc. is a Canada-based specialty pharmaceutical company. The Company addresses medical needs in metabolic disorders to promote healthy ageing among human immunodeficiency virus (HIV) patients. Theratechnologies’ product, EGRIFTA (tesamorelin for injection), is used for the reduction of excess abdominal fat in HIV-infected patients with lipodystrophy.

- Market Cap: $167

- Expected Report Date: 9/28/2016

- Implied Upside: 55%

- Price Target – Mean: $3.98

Firan Technology Group Corp. (TSE:FTG) – $2.78

Firan Technology Group Corp. (TSE:FTG) – $2.78

Aerospace & Defense

Firan Technology Group Corporation (FTG) is a Canada-based supplier of aerospace and defense electronic products and subsystems. The Company operates through two segments: FTG Aerospace and FTG Circuits. The FTG Aerospace segment manufactures illuminated cockpit panels, keyboards, bezels, and sub-assemblies and assemblies for original equipment manufacturers (OEMs) of avionics products, as well as for airframe manufacturers around the world. These products are interactive devices that display information and contain buttons and switches that can be used to input signals into an avionics box or aircraft. The FTG Circuits segment is a manufacturer of technology printed circuit boards. It serves customers in aviation, defense and other technology industries.

- Market Cap: $61

- Expected Report Date: 10/4/2016

- Implied Upside: 60%

- Price Target – Mean: $4.45

Aphria Inc. (CVE:APH) – $2.71

Aphria Inc. (CVE:APH) – $2.71

Pharmaceuticals

Aphria Inc., formerly Black Sparrow Capital Corp., is a Canada-based company, which is engaged in producing and selling medical marijuana through retail sales and wholesale channels. The Company’s retail sales are primarily sold through the Company’s online store, as well as telephone orders. Its wholesale shipments are sold to other Medical Purposes Regulations (MMPR) Licensed Producers. It offers medical cannabis of various strains, including Kusawa, Tamaracouta, Panache, Churchill and Iroquois.

- Market Cap: $242

- Expected Report Date: 10/7/2016

- Implied Upside: 37%

- Price Target – Mean: $3.70